Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

Gold is an investment asset that attracts many investors during periods of economic uncertainty. Its price fluctuates based on supply and demand, which makes it an ideal safe haven during tough times.

The price of gold is determined by several factors, including global and national economic trends, political tensions, and inflation. It also depends on the futures market.

Gold Rates

When it comes to gold bullion prices, there are a number of factors that play a role. These include supply and demand, currency fluctuations, inflation risks and geopolitical uncertainty.

Interest rates have a significant impact on the price of gold. This is because higher interest rates mean that it costs more money to invest in gold compared to other types of assets.

This phenomenon, called opportunity cost, can be a major factor in determining whether or not it is worth investing in gold. It is why many people choose to hold the yellow metal during economic strife.

However, despite the fact that gold does not pay any interest, it still offers investors a lot of room for capital gains in a healthy economy. It is also a safe haven that can be used to protect one’s wealth from paper dollar devaluation.

Bullion Market Meaning

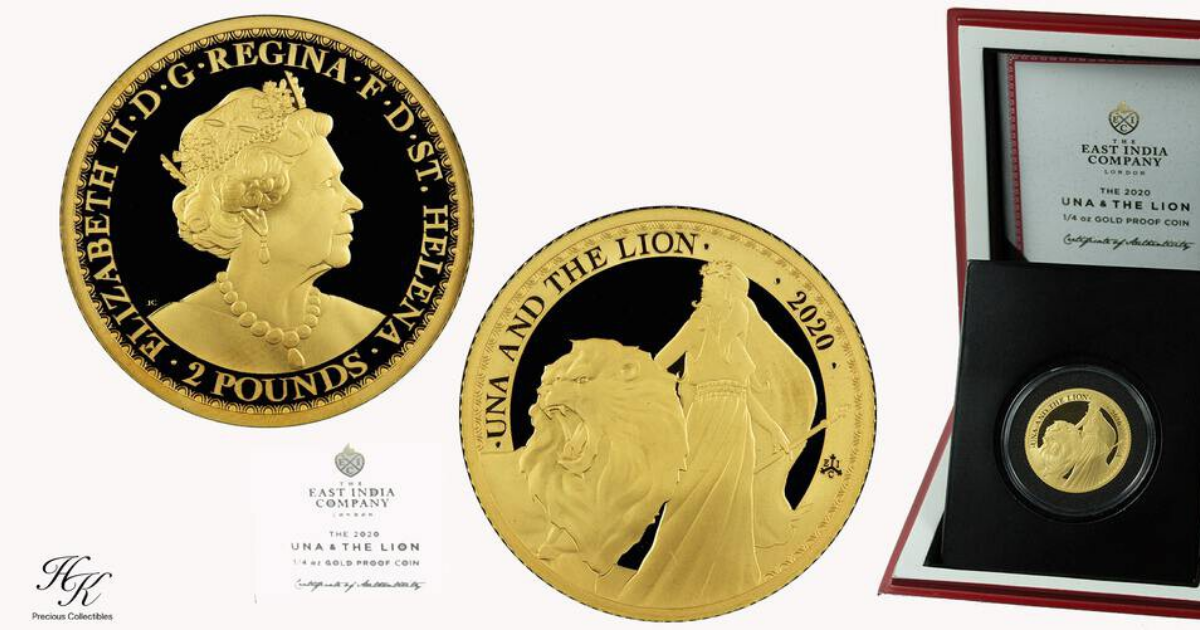

The bullion market refers to the markets for precious metals such as gold, silver, and platinum. It involves coins, bars, and other physical forms of the precious metals.

The price of these precious metals fluctuates, and it is important to know the meaning of these prices so you can make informed purchases. There are several different ways to invest in precious metals, so you should choose the best option for your needs and budget.

The prices of gold and other precious metals are set by international futures exchanges. These futures are based on the LBMA gold spot price, which is a market price for gold that is set twice daily.

Gold Trading

The gold bullion price is the price of a specific unit of gold (bars, ingots or coins) at any given time. It is influenced by many different factors, including supply and demand, market sentiment, currency values and more.

Investing in gold is considered a safe haven asset during times of economic uncertainty. However, the volatility of gold prices can be high and can result in losses if you do not have proper money management principles in place or use stop-loss orders effectively.

There are various gold trading strategies that you can use to trade the metal. Some of the most common include price action and trend trading. These strategies rely on chart analysis to identify price movement patterns and enter or exit a position when the trend aligns with your strategy.

Gold Merchant

Gold merchants play a key role in the gold market by facilitating gold trades between miners, investors, consumers and others. They offer a variety of services such as gold hedging, storage and buying back.

The best gold dealers are willing to engage with customers, whether it is in the form of answering questions, addressing concerns or discussing prices. If a gold dealer does not seem excited about these types of interactions, you should look elsewhere.

There are several gold markets around the world, including the London Gold Market and CME’s Globex electronic trading platform. These markets are gold price takers, taking in the international gold price and quoting their own local country prices to reflect that value.

In order to be a successful gold dealer, you need to establish good delivery and storage arrangements as well as facilitate buy-backs for your clients. You should also offer your clients a full range of products, and provide the highest possible level of customer service.

Frequently Asked Questions

Should I convert my IRA into gold?

Long-term gold investments are possible with gold. This is not a short-term trend. There are many options if you require cash immediately.

Your money may be best kept in a portfolio that includes bonds, stocks, mutual funds, and exchange traded funds (ETFs). You may also want to open a Roth IRA account if there are no retirement savings.

A traditional IRA allows you to contribute after age 18, while a Roth lets you put money into your own pocket tax-free when you retire.

The advantage to a Roth is that withdrawals are taxed as ordinary income when you take them at retirement rather than when you make contributions. This means that your money does not become taxed.

You won’t owe any taxes on the earnings of a Roth IRA until your retirement.

If you’re still working, however, the IRS limits how much you can contribute to both types of accounts. For 2018, those limits are $5,500 per year ($6,500 if you’re 50 or older) for a Traditional IRA and $1,000 per year ($1,100 if you’re 50 or over) for a Roth.

If you choose to invest in gold, remember that it’s a form of currency subject to inflation. This could mean that your investment in gold may lose value over the long-term.

Is it possible to buy gold using my self-directed IRA

This depends on whether or not you are an individual investor. If you’re unsure what kind of retirement plan you have, check your paperwork. To determine the plans that are available, you may want to consult your financial advisor.

If you don’t have any retirement plans, you can open a Roth Individual Retirement Account (IRA). You can make tax-free contributions to a separate account, which you can access from your regular paycheck. When you retire, you will be able to take money out of the account and not pay taxes until you withdraw it.

You can use your money in your Roth IRA as part of your estate planning strategy. You don’t have to pay income taxes on your earnings so there won’t be any inheritance tax when you die.

How can a gold IRA generate money?

It makes money by investing in gold. On the amount you own of gold, interest is paid each year. Owning gold in an IRA is free.

Should I have physical gold?

Consider these questions when deciding whether or not to invest in physical gold. Are there signs of inflation? Do you anticipate interest rates rising?

Do you value safety or liquidity more? What do you plan to do with the money once you’ve invested it? What about when the prices drop?

These are all valid questions to ask yourself. However, ultimately it comes down to what risk you are willing to take in exchange for the potential rewards.

Physical gold could be worth your consideration as a way to diversify against uncertain futures. However, it’s also possible that the price could plummet, leaving you with a loss.

It is important to weigh the risks against the benefits before making a decision. You’ll need to determine your goals and what kind of return you’re willing to accept before making a final decision.

Should I store gold at-home?

Keep gold safe at your home if you purchase it as an investment. But if you intend to use it as an investment, it is best to keep it at home. It’s just another kind of money.

How much does gold storage in a bank cost?

All this gold is kept safe by banks costs 1 million dollars each year. That’s why they charge you for storing your gold at the bank.

There are many ways to protect your savings and prevent theft from other disasters. You can put your money in an insurance policy that protects you from losing it. You could also invest in gold bullion. Gold bullion can be described as a physical money. It is real because it is believed to have real value.

Banks hold gold bullions and use them as legal tender. They’re not just kept in vaults but also used to make jewelry. You can even find them in shops around world. Gold bullion can be stored anywhere you want. Your gold is always available when you need it.

Talking with your financial advisor is the best method to decide how much you should invest in gold. He will explain all options to you and help you decide if investing in gold is right for you.

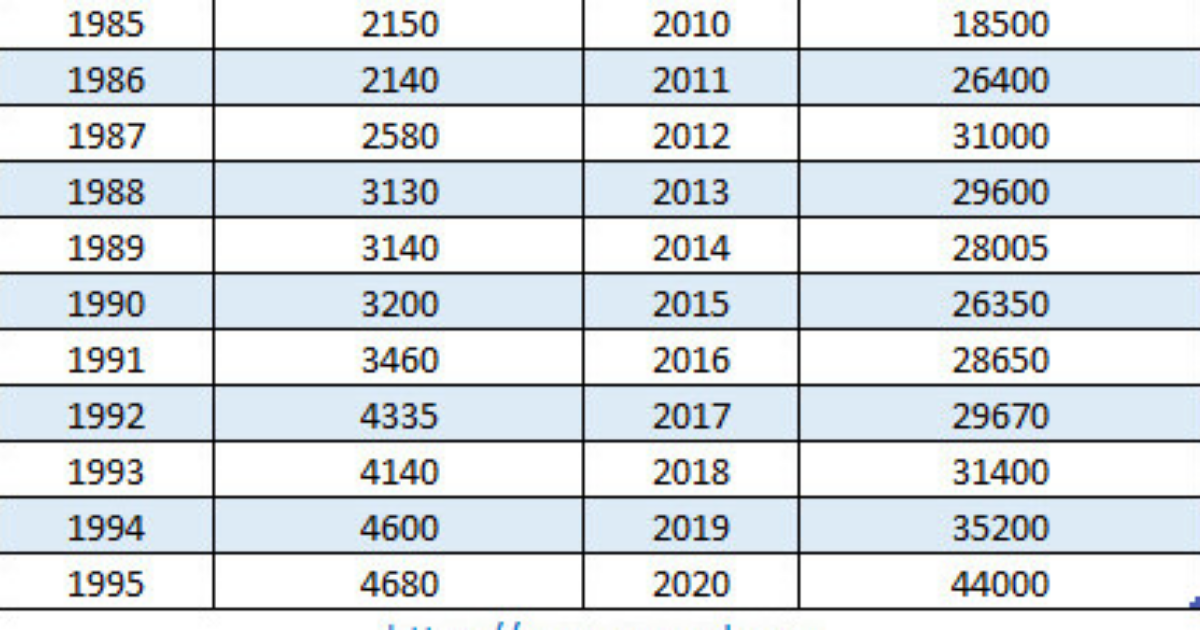

Statistics

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- That’s almost a 5% markup over a comparable amount of gold bullion. (forbes.com)

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

External Links

finance.yahoo.com

- Barrick Gold Corporation (GOLD) Stock Price, News, Quote & History – Yahoo Finance

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

jmbullion.com

investopedia.com

How To

How to order gold coins online

An online buying process for gold allows you to buy physical coins from dealers who then sell them wholesale. Most dealers sell their products online through sites like Amazon, eBay, and others. There are many choices when it comes buying gold online. There are many sellers who offer lower rates than others. These sellers will save you money if you are looking to save money.

Because of its ease-of-use and convenience, online shopping is very popular. It makes it possible to shop online without visiting any stores. The website allows users to browse the various products and make purchases. Most people prefer buying gold online over visiting brick-and-mortar shops when it comes to purchasing. Because they don’t need to travel to the store, this is a great option. They also don’t need to wait in long lines. Online shopping is easy and convenient because of this. Online gold shopping is easy if you can trust the seller.

Online gold purchases offer the best option because you can choose the kind of metal that you wish to purchase. Online purchasing gold is a great way to buy silver coins. Moreover, you will get to see the quality of the product before making the final decision. In addition, you will learn about the item’s price range. You can then compare sellers to find the one that best suits your needs.

The best thing about buying gold online? You won’t have any shipping charges. Most of the sellers offer free shipping services. The only thing you need to do is pay attention to the delivery fees, which will vary depending on your location. However, if you wish to avoid paying extra fees, you can opt for the local pickup option. After payment confirmation, the seller will deliver your order right to your door.

There are many advantages to buying gold online. Some of them include:

- Convenience- You can purchase gold online. You can log into your account to place your order.

- Quality – You will not face any problems regarding the product’s quality unlike traditional gold selling methods. You won’t lose anything because the product will arrive right at your door.

- Price – Online purchases of gold are a great way to save money. As mentioned earlier, you will only need to pay for the shipping charges. Therefore, you will end up saving quite a bit of money.

- Selection – You can still choose from different types and buy gold online from multiple sellers. For instance, you can choose between bars or silver coins.

- Variety – Gold can be purchased online from many countries, including the USA, UK, Canada and Australia. You can expect to find a large selection of gold online.

- Brand Name – Another reason to buy gold online is the opportunity to purchase it under a registered brand name. These brands are known all over the world. You can be sure of high-quality products if you purchase gold under these brands.

- Customer Service – If you have any problems ordering, contact our customer service team. In case you have any questions, they will be happy to assist you.

- Shipping Options – There are many shipping options for gold purchased online. You have the choice of local pickup or express delivery.

- Returns Policy: Before purchasing gold online, it is important to read and understand the terms of return. You may need a refund in certain situations. Some sellers may offer refunds regardless.

- Payment Methods – Most sellers accept credit/debit card payments. Some sellers do charge a small processing cost. You should verify whether credit cards are accepted by the seller.

- Delivery Time – After you have completed your transaction, you’ll receive an email confirmation. This email includes information about the tracking number and the estimated delivery time.

- Security – When buying gold online, make sure the website has an SSL cert. This ensures your data remains safe.

- Taxes: Some countries impose tax on purchases of gold. You should be aware of the tax that would apply in such instances.

- Reputation – Every company wants a great reputation. Similarly, if you want to buy gold online, you should ensure that the company you are dealing with has a good reputation.

There are many reasons to buy gold online. You don’t have to wait any longer! You can place your order right now!