Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

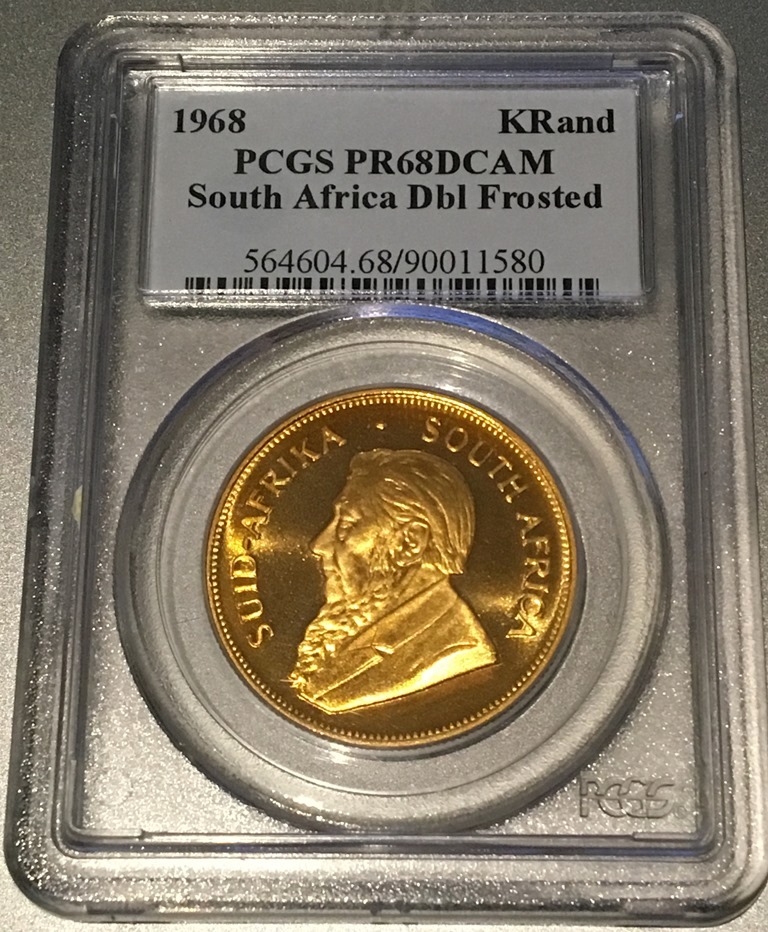

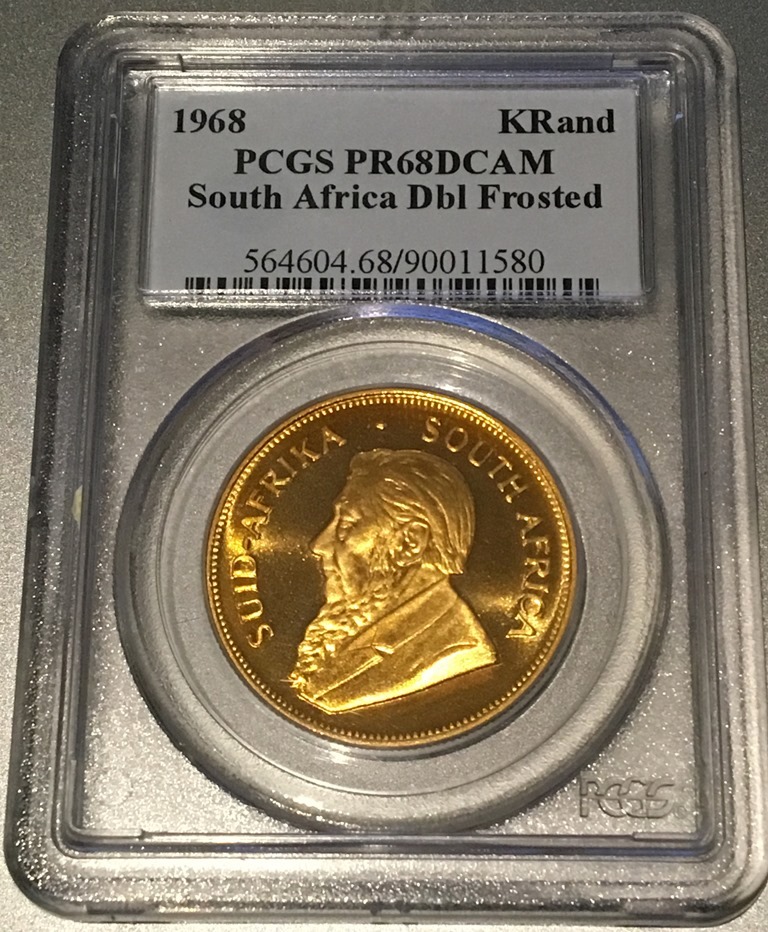

The Krugerrand is a South African coin that is made of gold. It has a legal tender value, but does not have a monetary face value. Instead, its value is tied to the price of gold in the market. While the Krugerrand is composed of more than ninety percent gold, blemishes and other defects can reduce its value significantly.

An antelope

The gold Krugerrand is one of the most popular investment coins in the world. The obverse shows a profiled bust of former president Paul Kruger and the words “South Africa” and “1 oz fine gold.” On the reverse, the coin depicts the springbok antelope, South Africa’s national animal. The coin also bears the mint date.

The antelope on the South African Gold Krugerrand is a symbol of abundance and prosperity. It also represents the weight of gold. The antelope also appears on the country’s five-shilling pieces. The springbok is the national animal of South Africa and its name is derived from the Afrikaans words for “jump” and “antelope/goat.” The antelope is a member of the antidorcas genus of bovines.

Gold-copper alloy

The Kruger Rand is a gold coin made from a 22-carat gold-copper alloy. These coins are more durable than gold bars and are easy to transport. Collectors often purchase gold Krugerrands regularly from a specialized dealer. Copper-alloyed gold coins are also harder and scratch-resistant than silver-alloyed coins.

The coin’s obverse depicts the face of Boer statesman Paul Kruger, and the reverse shows the springbok, the national animal of South Africa. The springbok design was created by Coert Steynberg, who was also responsible for the design of earlier coins. The Krugerrand’s value depends on its gold content. The coin is a registered trademark of the Rand Refinery Limited.

Premium over spot price of gold

Kruger Rand gold coins are considered to be one of the most popular gold bullion coins in the world. Unlike other gold bullion coins, the Krugerrand has a low premium over the spot price of gold. The premium is usually between five and ten percent. However, this premium varies from coin to coin, as larger coins have lower production costs. Thus, it is important to consider the premium when purchasing a Krugerrand.

The premium on Krugerrands is added to the gold content of the coin, plus any mintage and shipping costs. This premium is the seller’s profit. A savvy buyer will know exactly what they’re paying for. In addition, the premium is lower on second-hand Krugerrands compared to brand new ones. Buying Krugerrands in bulk can be a great way to increase the value of your gold holdings.

Limited mintage

The Krugerrand is a South African coin that was first minted in 1967. It was created to help the country market gold. It was created by the Rand Refinery and the South African Mint. The name of the coin is derived from the name of the former South African President Paul Kruger. On the reverse, the coin has the name of the country, as well as the face value of one Rand.

The Krugerrand is one of the world’s most prestigious bullion coins. Originally designed to attract gold investors, the coin is a popular investment choice. It is the first gold bullion coin to be produced in a large quantity.

Value

The value of Kruger Rands fluctuates considerably on the gold bullion market. As such, it is not practical to list fixed prices for these coins. Rather, we will use the gold price, plus a 3% to 5% premium, to determine the price of Krugerrands.

Krugerrands are highly concentrated forms of gold. There is no face value for these coins, but the Republic of South Africa guarantees them as legal tender, based on the gold spot price. The coins are minted every year and are available for investors and collectors in two forms: proof and bullion. Proof coins are aesthetically more attractive and have a mirror finish background. They are also produced in smaller quantities than their bullion counterparts.

Availability

Krugerrands are one of the most popular forms of gold bullion in the world. The coin was originally minted in 1967 as a collector’s item but mass production of them started in the 1970s. They were designed to promote the ownership of gold, and are minted with 91 2/3 parts gold and 8 1/3 parts copper. By the end of the 1970s, they accounted for 90% of the gold coin market.

The Krugerrand is made by the South African Mint, which works in collaboration with the Rand Refinery. The Mint is a wholly-owned subsidiary of the South African Reserve Bank. It was founded in 1886, shortly after gold was discovered near Johannesburg in the Witwatersrand area. Today, it is one of the largest exporting mints in the world.

Frequently Asked Questions

How much gold can I keep at home?

The average person keeps around $500 worth of gold at home. But if you’re looking for an investment opportunity, you might want to consider investing in bullion bars. These bars are solid pieces of metal that actually contain gold. They could be sold to make more money.

You should only invest what is right for you. A financial advisor can help you determine where to start if you are unsure of where to start. They will be able to help you choose the right investments for you.

What is the safest way to own gold?

An investor’s best investment is gold. However, investing in gold comes with risks. One of them is storing your gold safely. If you store your gold somewhere safe, how do you ensure it doesn’t disappear? Insurance is a great way to protect your gold. Insurance provides protection against loss. Insurance is bought because you believe the potential loss outweighs the benefits and costs. For example, if you lose $10,000 worth of gold, you might consider paying $1,000 per month towards a policy that covers it. There are two types, term life insurance or whole life insurance. Term life insurance covers for a certain period. Whole life insurance pays a set amount each year for as long as you live.

Savings accounts are the best way to invest your money. These accounts earn interest which allows you to save more while also earning more. These accounts are excellent investments since your money grows indefinitely without any tax. FDIC Insurance is another safety feature in savings accounts. It guarantees that 100% of your money will be returned to you if your account goes bust. Savings in a bank can be accessed wherever you are. Banks are typically open 24/7, seven days a weeks.

You might also consider precious metals storage. Precious metals storage involves keeping gold and silver coins, bars, jewelry, and bullion in a vault or safe deposit box. Make sure you get competitive rates and secure storage for precious metals.

Are gold IRAs a good idea or a bad idea?

The answer will depend on who you’re asking. If you’re just beginning, they can help you build wealth over the long-term. If you have an existing business, there are other ways to invest your money.

For example, you could start a business. This will give you greater control than buying gold coins via an IRA.

You might also consider selling some of your gold coins and investing the proceeds in stocks or bonds. This would allow for diversification in your portfolio.

An IRA can help you if your goal is to retire young. When you reach retirement age, your assets can be withdrawn from your IRA without any taxes.

You don’t have to only use one type account to purchase gold coins. There are other types of accounts that offer a variety of different investment options. For example, you can open a stock brokerage to start trading shares. You can also set up an online banking account and start making withdrawals and deposits.

How do you store 1 Oz gold bars?

If you buy gold for storage, choose a reputable company. There are not all companies that can offer you the same level of security when storing gold.

One company may even have multiple accounts. If this happens, it could mean that more than one person can try to steal your golden. You might lose your precious metal because someone else stole it while you weren’t watching.

It is also important to ensure that the vault is protected from theft. Some vaults are easily accessible from the outside. Others are hidden underground which makes it harder to break in.

Make sure to get an armored service for your car that offers 24-hour protection. Make sure that you have coverage for any damages to your vehicle.

Last but not least, make sure you keep track of your gold and whereabouts at all times. A safe deposit box is probably the best place to put your gold. It is important to keep the box emptied on a regular basis to prevent it from becoming damaged.

Are gold coins allowed to be kept in an IRA

In IRAs, gold coins cannot be invested. Their collectibles are not allowed by the IRS.

An IRA account cannot hold gold coins.

However, you can still hold gold coins for your personal use.

IRAs are intended to provide tax-free income for investors over time. The IRS will not interfere with your ability save as long as you comply with the rules. The IRS will not interfere with your ability to save. However, it is important that you understand that having gold in your IRA may reduce the amount you have available for investing elsewhere.

This is often a good thing. The price of gold will rise with the market. The price of gold will fall, and so will your holdings.

So if you plan on keeping your gold coins in your IRA, you need to consider the risks involved. First, determine how much gold your have. Next, you will need to determine the gold’s value. The last step is to determine if there are enough funds to cover possible losses.

You may have to sell your investments if you don’t have the cash to pay these losses. You might have to liquidate some of you retirement savings in order to pay off your debts.

Once you are sure you have enough money, you can buy gold coins.

How does a precious metals IRA work?

You can make investments in physical gold and silver as well as platinum bullion coins through a precious metal IRA. You can also purchase shares in the companies producing these physical products. The shares are then held by an independent custodian in trust until they mature.

You can sell the assets and receive the cash proceeds tax-free. Capital gains tax is also not applicable due to the asset’s appreciation.

Although a PMIRA can be similar to investing in stocks, it provides greater diversification as you have tangible assets rather than financial instruments. You aren’t exposed to stock market fluctuations, so it’s less risky than investing in direct equities.

The IRS requires you pay ordinary income tax on dividends received from these investment choices. The IRS does not require you to pay federal income tax on earnings from the Gold Individual Retirement Accounts (IRAs) if your account qualifies.

There may be income taxes in your state that you owe if you are selling precious metals. These taxes are different from state-to-state. Talk to your accountant or tax advisor about which state you should file.

Statistics

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

- Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

External Links

finance.yahoo.com

- Yahoo Finance: Barrick Gold Corporation, (GOLD) Stock Prices, News, Quotes & History

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

investopedia.com

jmbullion.com

How To

How to Invest Physical Gold

When investing in physical gold, there are several things to consider. While physical gold is generally cheaper than investing directly in stocks, bonds, or real estate it is still very expensive. You need to make sure that you are fully informed before you invest your money. These are some helpful tips to help you do it correctly.

- Choose a reputable dealer who sells only certified coins. A dealer who sells bullion bars should be specialized in their sale. They should be able provide you with a Certificate of Authorization (COA). It is a proof that the coin was made from gold, and it also has its serial numbers. The COA should include the weight and purity.

- The price history of your desired type of gold is important. You can check the spot price for gold per ounce to see if the market is moving up or down. The price per gram is the cost per thousandth of an ounce. This is useful because most people prefer to weigh their gold rather than count grams.

- Ask yourself whether you think gold’s price will go up, or down. It is hard to predict where the price for gold will go. Don’t get attached to any one price point. But if you feel like the price will rise, look for recently minted coins. Coins produced years ago tend to be worth less now because they haven’t increased in value very much.

- You should only buy items with low mintages. The mintage is used to determine the coin’s rarity. For example, the U.S. Silver Eagle Coin has a total mintage of 1,000,000. It means that only 10 million coins are produced each year. You won’t pay nearly as much for a silver dollar the next time you purchase it.

- Consider the condition of the coin. You would not want to buy a piece that looks worn if your budget is thousands. You shouldn’t purchase jewelry that has signs of wear if it is intended to be an investment.

- Check the condition of the metal. When you buy a gold bar, you’ll often notice that it doesn’t look smooth. It’s not pure gold, most of it is. It has impurities such copper and nickel. The certificate of analysis will confirm the purity of the gold. This document will show you the percentage of each element contained in the gold.

- You should never buy something you cannot afford to loose. Even if you aren’t planning on spending tens of thousands on an item, you shouldn’t put all your eggs in one box. You may lose a lot of cash if the item is not sold by the time you are ready.

- Keep track on all purchases. You should keep track of every purchase. You can avoid being stuck with something that you regret.

- Avoid dealing with private sellers. Many websites offering low prices are scams that attempt to lure buyers. Before making a deal, always ask for references. Never send money up front.

- Avoid online auctions. While some sites offer amazing deals, others charge high fees. Before bidding on any site, be sure to understand what you are getting.

- How to store your items. Most precious metals are resistant to temperature changes. However, some coins and jewelry require special storage.

- Be careful when purchasing from abroad. Many countries don’t require proof to prove that gold has been authenticated. Unsuspecting foreign customers can also be taken advantage of by unscrupulous individuals.

- Learn the differences between rounds and bullion bars. Bullion bars consist of solid pieces made from gold. Small amounts of gold are contained in round. They’re lighter and more transportable than larger bars.

- Read the fine print. You should understand all terms and conditions. You might find certain clauses that permit the seller to modify their mind after you have paid.

- Never accept cash in exchange for gold. Cash transactions have risks, especially when dealings are made with people outside of your country.

- Research the market carefully. If you are able to buy something at an affordable price, it is worth considering reselling it at higher prices.

- Beware of frauds Many websites advertise cheap gold prices. However, they are often trying to trick you.

- Get expert advice. If you feel like you are being taken advantage or don’t understand something, it is worth seeking legal advice.

In conclusion, investing in gold is a smart move. It has been around for centuries, and it still holds its value well today. But you should be cautious about where to invest. As mentioned above, there are many different ways to invest in gold. Be wise!