Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

When it comes to investing, one of the key factors to consider is diversification. This is a concept that can help to ensure that your investments remain stable and reliable over the long term. There are a number of ways to achieve diversification, including purchasing different companies and commodities. Also, there are certain strategies that can be used to help rebalance your portfolio.

Commodities

Commodities are an important asset class. They offer excellent returns in times of high inflation and market uncertainty. However, they are volatile, which can make them difficult to invest in. Consequently, small investors should be careful about putting all their eggs in one basket.

The best way to diversify through commodities is to invest in a portfolio that incorporates all globally traded commodities. This includes agricultural and industrial commodities, as well as precious metals.

In order to get the most out of your commodities investment, you should consider incorporating demat holdings and exchange-traded funds. These funds can drive prices of essential commodities, and can also help broaden your diversification.

While you are at it, be sure to include a few other investment options. You may be able to get better returns in other areas of the financial world, such as foreign stocks.

Companies

While there’s no such thing as a foolproof way to manage your investment portfolio, it’s not impossible to come up with a solid plan of attack. To start, consider an unbiased financial adviser. The resulting strategy will be tailored to your unique financial needs and objectives. Using a reputable advisor will ensure the long-term success of your investment portfolio. For a small fee, an adviser will help you craft a plan that’s uniquely tailored to your specific financial situation. By incorporating a solid planning and execution regimen, you’ll be able to achieve your financial goals and dreams in the most efficient and timely manner possible. This is especially true if you’re interested in investing in the stock market or buying real estate.

Asset classes

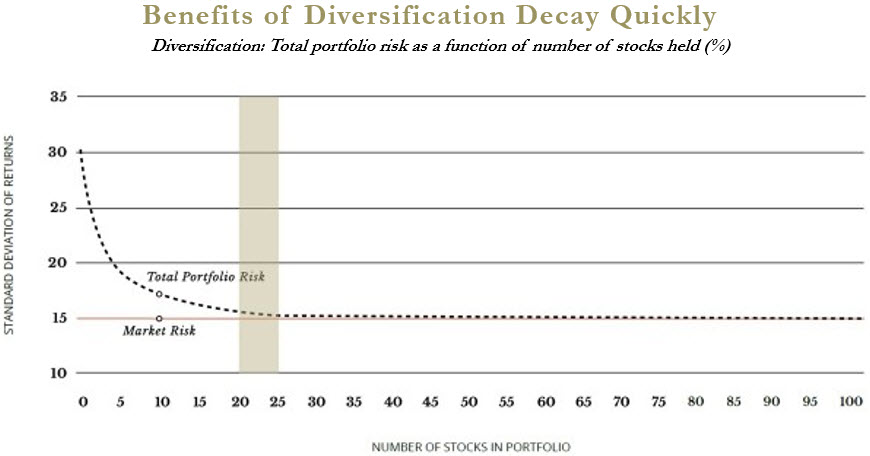

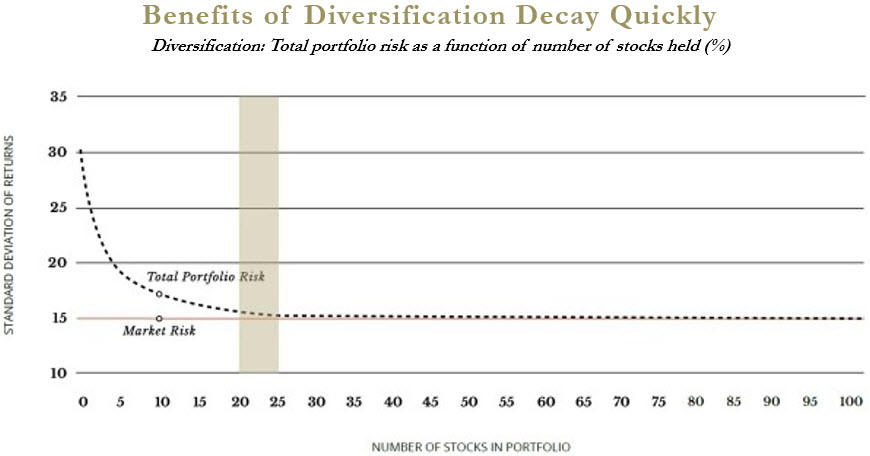

Diversification is the process of spreading money across different asset classes, such as bonds, equities, and real estate. This helps to reduce risk and increase the likelihood of satisfactory returns. However, a diversified portfolio is not a simple formula. There are many factors to consider, such as the time frame of the investment, your risk tolerance, and your investment goals.

In addition to diversifying, you should also take into consideration the types of risk that already exist in your portfolio. Consider the impact of a market decline on your overall portfolio. You may want to invest more in cash or a more stable asset class.

It is important to understand the difference between systematic and market risks. Systematic risk is a more unpredictable type of risk that you cannot predict. Market risks can cause stocks to fall and the value of assets to increase.

Rebalancing

Rebalancing investment diversification is an important step in the portfolio management process. It can help to prevent unintentional exposure to risk. The timing of rebalancing depends on your financial goals. Some investors rebalance once a year, while others rebalance more frequently.

When an investor rebalances, he or she buys securities that are underweight in a particular asset class or sells securities that are overweight. This is usually done in order to achieve a target allocation of stocks and bonds.

Investing can be a long-term business, so you should ensure that your investments are well-diversified. You should also be aware of the risks involved. Not rebalancing your portfolio can result in significant losses. A rebalance can also improve your returns. However, it is always a good idea to consult with a qualified financial advisor before making any changes to your portfolio.

Indexing

Diversification is a major benefit of investing in an index fund. A diversified portfolio can protect you against the risk of an all-stock portfolio. It is important to monitor your asset allocation regularly.

You can increase diversification by owning a variety of sectors and stocks, and by diversifying your portfolio by geography. This is a simple strategy for reducing risk and increasing performance.

If you are planning to invest in an index fund, you should do your research. You should find out how the fund is diversified, and what it will invest in. Also, make sure you understand the costs of the funds.

Index funds offer a low-cost, passive solution for diversifying your investments. They allow you to choose from a wide variety of asset classes, and you don’t have to be a financial expert to pick them.

Frequently Asked Questions

Can you keep gold coins in an IRA?

In IRAs, gold coins cannot be invested. They are considered collectibles by the IRS, so they are not permitted.

You cannot place gold coins in an IRA account because they are property.

You can still keep gold coins for personal use.

IRAs can provide investors with tax-free income over time. As long as you adhere to the rules, the IRS will not restrict your ability to save. The IRS will not interfere with your ability to save. However, it is important that you understand that having gold in your IRA may reduce the amount you have available for investing elsewhere.

This is usually a positive thing. The market will rise, and so will the gold price. When the price of gold falls, so will the value of your holdings.

Consider the potential dangers involved if your plan is to keep your gold coins within your IRA. First, you must know how much of your gold you have. Then, calculate the gold’s worth. Then, determine if you have enough cash to pay for any possible losses.

You may have to sell your investments if you don’t have the cash to pay these losses. You might have to liquidate some of you retirement savings in order to pay off your debts.

When you have determined that you have enough cash to handle the situation, then you can proceed with the purchase of gold coins.

How do you purchase gold coins for your IRA?

You need to know how much money you have available (or what kind of account you use) because there are different ways to purchase them. You could, for instance, ask a bank to buy $10,000 worth of physical coins. If you have a retirement plan at work, they may allow you to make a withdrawal from your 401(k). This is known as a direct rollover and it is usually completely free. The IRS stipulates that withdrawals to a retirement account must be made through physical gold coins.

If you already have a Traditional IRA, funds can be transferred directly to a Traditional IRA. This is known as self-directed retirement accounts. While it isn’t mandatory to do this, most people choose to do it. Contact your financial advisor and let him/her know which accounts you’d like to transfer the money into. Your advisor will then help you transfer the money to an IRA.

You can also use online platforms such as bullionvault.com or coinbase.com to buy physical gold coins. These services act as middlemen between buyers and sellers and charge fees. They hold the coins until someone buys them and then deliver them to the buyer once payment is received.

How much does it set you back to store your gold in a bank vault?

Banks pay 1 million dollars per year to store all this gold. This is why banks charge for gold storage at the bank.

But if you want to protect your savings from theft and other disasters, there are many ways to do that. An insurance policy will protect you against losing your money. Or, you could purchase gold bullion. Gold bullion is a physical form of money. It has real value because people agree that it does have value.

Banks can store gold bullions as legal currency. They are used for jewelry making and not just stored in vaults. They are also sold in shops all over the globe. You don’t need it to be stored elsewhere if you have gold bullion. Your gold is always at your disposal when you are in need.

Talking to your financial adviser is the best way to determine how much gold you should invest. He will inform you about the options available to you, and help decide whether gold investing is right for your needs.

Statistics

- That’s almost a 5% markup over a comparable amount of gold bullion. (forbes.com)

- But like gold coins, you’ll probably be paying extra for the amount of gold you’re getting—a premium that could be anywhere from 20% to 300%, depending on the manufacturer. (forbes.com)

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

External Links

forbes.com

jmbullion.com

nytimes.com

- The New York Times – Safe Deposit Boxes Not Safe

- Are All the Gold & Silver in Storage? (Published 2020)

How To

Top Gold IRA companies: Best Gold Investment Retirement Accounts in 2022

The top 2022 gold retirement account options for investors

For 2022, the best gold retirement accounts (IRAs) are those that allow you to invest money without worrying about taxes or fees. You can buy shares in stocks, bonds, commodities, real estate, etc. You can use our calculator to calculate how much money you will earn.

The Gold IRA company offers many options to invest in precious metals, such as gold and silver, platinum, palladium and even Bitcoin. These companies offer clients a safe way to store their wealth and provide them with tax benefits and low transaction fees.

The benefits of precious metal IRA investments are numerous. Precious metal IRA investments offer diversification from traditional asset like stocks and bonds. Diversifying your portfolio will ensure that no one asset is affected by a decrease in its value. Additionally, these investments can be protected during economic downturns. This means that even if the economy turns sour, you might still come out on top compared to someone who invested heavily in volatile stocks.

An additional benefit to precious metal IRAs, is the fact that they typically pay higher interest rates then traditional savings accounts. An extra $100 per month could be earned by precious metals investments if you get a 10% return annually.

Precious Metal IRA companies usually don’t charge sales commissions so there are no hidden fees. Plus, there are usually no minimum account balances required. So, whether you decide to open a new account or transfer existing funds into a new IRA, you should find plenty of opportunities to save.

You can take advantage of the federal government’s tax-free status by ensuring that your precious metal IRA company offers qualified plans. There are two types if qualified plans – 401k(b)s and 403b(b)s. Both allow you pre-tax dollars to a Roth IRA. Only 401 (k) plans allow you to withdraw your contributions after the age of 59 1/2, and without any additional taxes.

To invest in precious metal IRAS, you don’t need to wait until retirement. Many people use their employer IRA to invest precious metals as it defers taxes. Your employer doesn’t have any limits on how much you may contribute to your workplace IRA, unlike other IRAs.

Some employers even match your contribution. If you work at an organization that matches your contributions, you may be able to boost your savings by thousands each year.

What are you waiting for?! It’s never been easier to invest in precious metal IRAs.