Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

Investing in gold is a good idea if you want to protect your purchasing power. Inflation and interest rates are two factors that have a huge impact on the value of gold. Investing in gold will also protect you from currency exchange rates.

Inflation is a primary driver of the price of gold

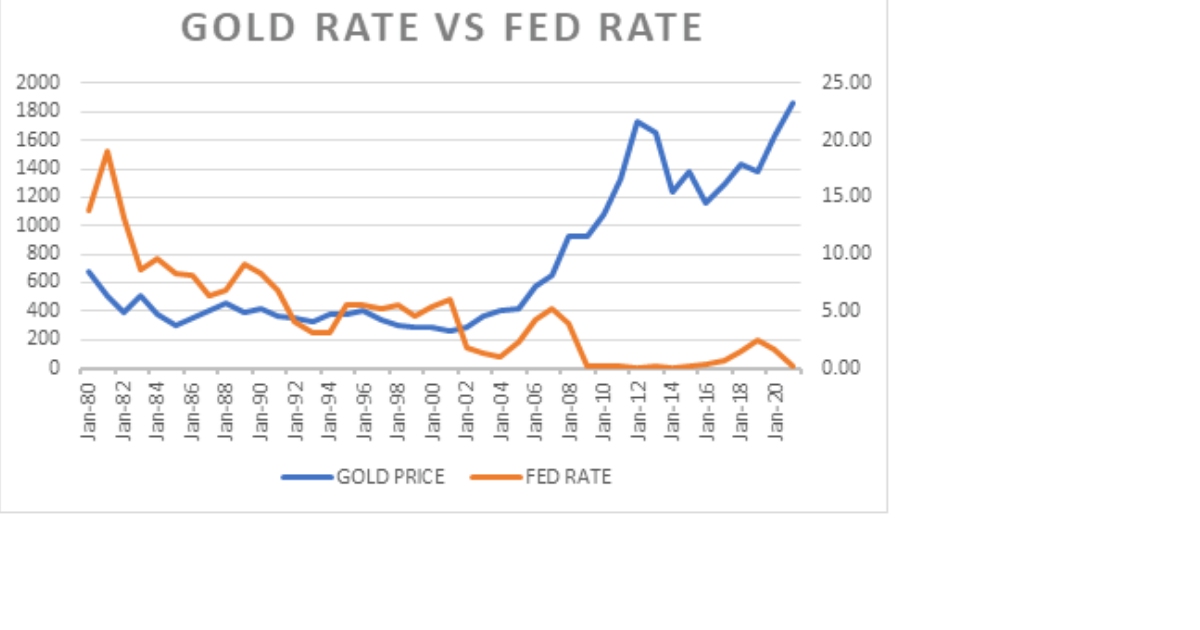

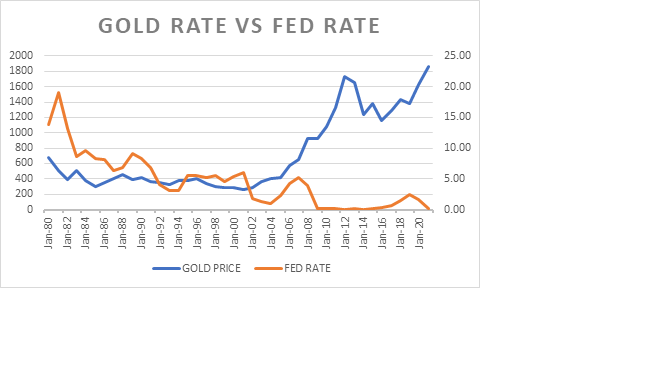

Historically, inflation has been a key driver of the price of gold. However, this relationship has become less consistent in recent years. The lack of inflation has coerced the Federal Reserve not to raise interest rates, which has been a major contributor to the decline in gold prices. However, in the months ahead, inflation will likely continue to play a major role in driving gold prices.

There are three broad groups of gold buyers. These groups are: consumers, investors, and industrial users. These three groups each have different inflation variables that affect their price expectations.

The Consumer Price Index is the most common measure of inflation in the United States. This index includes information such as wage data, manufacturing data, and GDP growth. A record-setting 11.2% increase in the PPI during the first half of the year represents the highest rate of price inflation in 40 years.

The increase in money supply can also have an impact on prices. The expansion of money supply is positively correlated with investor demand. However, monetary-driven inflation can lead to the erosion of purchasing power.

Faith in central banks affects the price of gold

Besides the alluringly named Federal Reserve Bank of New York, the central banks of a handful of other jurisdictions are responsible for the bulk of the gold. The following scribes are aplenty, including China, Russia and Japan to name but a few. Those are the big boys and their gold and silver cousins, and the ye ole dawgs are the small fry. Some of the best gold mines are still in their cribs, albeit at much lower yields. Having said that, there is no reason to expect that the following ye ole dawgs should not have a fair chance at making the grade.

Real interest rates are adjusted for inflation

Despite the hawkish turn of many central banks in the advanced economies, real interest rates have fallen in many countries in recent years. Longer-term real rates are negative in many regions, supporting higher prices for riskier assets.

Real interest rates are calculated by subtracting the nominal interest rate from the inflation rate. The real interest rate measures the time preference of the lender and the borrower. The lender wants to earn a return on the loan based on the expected consumption of future goods. The borrower is willing to pay a higher interest rate if he or she wants to use the funds for current goods.

If a bank makes a 10% loan with a nominal interest rate of 5%, the real interest rate is 5% – a number that does not change dramatically when inflation is high. However, the real interest rate varies between different lenders.

If inflation is high, borrowers may find it difficult to repay the loan in cheaper money. However, lower real interest rates benefit the borrower.

Investing in gold to retain purchasing power

Investing in gold is one way to protect your investment from inflation. However, there are important factors to keep in mind.

First, gold isn’t always a good investment. For example, gold tends to perform poorly during inflationary periods. This is because the purchasing power of the fiat currency is depleted. If interest rates rise, investors will flee from gold. Investing in gold as a part of a diversified portfolio may be a reasonable approach.

It’s also important to keep in mind the opportunity cost of investing in gold. You may find that you can make more money elsewhere. For example, you may find that you can invest in stocks for a higher yield. If you invest in bonds, you’ll also receive a dividend. However, you’ll also lose purchasing power if interest rates rise. Investing in gold can offset these losses.

It’s also important to keep an eye on the gold price. Gold is typically a store of value, so its price tends to go up when interest rates are low. However, its price is also affected by market volatility. Gold prices tend to fall when the stock market is booming.

Frequently Asked Questions

What’s the advantage of a Gold IRA?

Investors who have a lot of money to spare can make investments safely and not pay taxes on the gains.

The best thing is that there are no problems to be concerned about because the IRS will ensure that your account rules are adhered to.

You can also invest in silver and gold with Gold IRAs.

An example is to invest in an ounce gold and add a few silver ounces. This would give a total of 20 ounces for gold and 10 of silver.

You can, however, invest in only gold if desired. Many investors choose to do so because it’s easier to track their holdings.

You can diversify your assets by investing in gold IRAs. For example, you could invest your savings in gold while keeping some of your money in stocks and bonds.

This would be especially useful if you plan on retiring soon because it would help protect against inflation.

How is gold taxed in an IRA?

You can deduct any investment expenses, including taxes, associated with property like stocks or bonds from your income. Interest paid on loans for business purposes may also be deducted.

Qualified dividends, capital gains and losses are all included. If your deductions exceed $3,000 annually ($1,500 if married filing independently), then you can’t deduct them.

This deduction must be claimed every tax year. These losses can be carried over into future years, if you are experiencing a loss. Profits made in one year can’t be used to offset losses.

Should I move my IRA to gold?

Gold is an investment that can be sustained over the long-term. It isn’t a fad. If you need cash now, there are other options.

You might want to invest your money in a portfolio of stocks and bonds, mutual funds, exchange-traded fund (ETFs), and other investments. You might also consider opening a Roth IRA account if you don’t have any retirement savings.

A Roth allows you money to be withdrawn tax-free in your retirement years.

Roths have the advantage that you can withdraw money at retirement as ordinary income rather than making contributions. It means that your money grows tax-free.

Another benefit of a Roth IRA is that you don’t owe tax on any earnings until you withdraw the money.

However, the IRS restricts how much you may contribute to either type of account, if you’re still employed. The 2018 limit is $5,500 ($6,500 if your age is 50 or older) to a Traditional IRA, and $1,000 ($1,100 if your age 50 or older) to a Roth.

Remember that gold is an inflation-prone currency. Your investment could eventually lose its value.

Are gold coins allowed to be kept in an IRA

The IRS does not allow gold coins to be placed in IRAs. Their collectibles are considered by the IRS and they are prohibited.

The gold coins are property and can’t be put into an IRA account.

But, gold coins can be kept for personal use.

IRAs provide income that is tax-free over time. So long as you follow the rules, the IRS won’t interfere with your ability to save. You must be aware that gold held in an IRA can reduce your capital available to invest elsewhere.

This is usually a positive thing. As the market grows, so will the price for gold. When the price of gold falls, so will the value of your holdings.

Keep in mind the risks of keeping your gold coins inside your IRA. You must first know how much gold you own. Next, you will need to determine the gold’s value. Then, determine if you have enough cash to pay for any possible losses.

To raise cash, you might need to sell investments that you do not have enough money to cover the losses. You might have to liquidate some of you retirement savings in order to pay off your debts.

Once you have decided that you have enough cash to manage the situation you can then proceed with the purchase or gold coins.

How do you buy and safely store gold?

It is best to keep gold secure in a safe-deposit box at a bank. It is better to keep your gold at home than to store it in a safe deposit box at a bank. This makes it more difficult to find quickly in an emergency. Fireproof safes, which are the most widely used type of safe deposit boxes, are the most preferred. They are used by banks for protection against theft. To protect your gold, you could use a fireproof safe. These safes are costly. It is better to purchase a basic safety box from your local bank. These boxes cost less that $100 per year. In addition to being affordable, they offer additional security features like keyless entry.

You can also store your gold at a trusted precious metals dealer. Most dealers will provide free storage services, so you don’t have to worry about finding a place to store your gold after buying it. Some dealers even offer discounts on storage fees if you purchase multiple items at once.

It is important to keep your gold safe in your home. It is important that no one gets in the room where you have placed your gold. Make sure nobody has keys to the area. If someone does have keys, it is important to immediately change the locks.

You should ensure that your gold is insured by Federal Deposit Insurance Corporation (FDIC) if you store it in a bank. All deposits above $250,000. will be covered by the government if your bank goes under.

Is there a safest place for gold storage?

A safe deposit box at the bank is probably your best choice for storing valuable items like jewellery, coins, and other precious objects. The vault is safe because you need a key to access it. Also, identification is required for entry. The bank may require you to sign an agreement stating that you will not take any item without their permission.

A safe deposit box at a bank will generally cost less than buying insurance. However, you will have to pay monthly fees to keep it open. Additional coverage is recommended if the contents are to be kept inside for longer than 2 years.

Many online stores offer to store your precious metals for you. While some websites may look legitimate, others can be scams that will sell your information. Before using any website to store your gold, check its reputation. Seek out reviews from trustworthy sources and speak with family members who have used the website before.

Statistics

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

External Links

jmbullion.com

royalmint.com

finance.yahoo.com

- Barrick Gold Corporation (GOLD) Stock Price, News, Quote & History – Yahoo Finance

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

How To

How to invest in Gold Coins and Why

The safest investment for any type is gold coins. Their stability and high returns are the main reasons for this. There are many gold coins available and it can be confusing to choose which one to buy. We will show you how to select the right gold coin for your investment portfolio.

First, you should consider the amount of money you want to invest. If you only have a small budget, buying gold coins might not make sense. Gold coins can be a good investment if you have large funds. However, they are more profitable than other forms of investing. Start with small amounts of cash to ensure you don’t miss out on potential profits later.

Next, you need to consider how much return you are expecting from gold coins investments. There are two main categories of gold coins; physical gold coins and paper gold certificates. Paper gold certificates and physical gold coins are simply pieces of paper that represent some value. It is important to look for gold coins that offer a high rate of return. This means that you need to look at the market prices for gold coins and compare them with their historical rates. To calculate how long it would take for your initial investment to recover, let’s say you wanted gold coins that returned 5% per year.

Number of Years Initial Investment / (5%x Number Of Years).

If you know how many years it takes to make a decision about buying gold coins, you can then decide whether it makes sense. It is important to note that this equation assumes that gold coins are purchased at the beginning of each year. The calculation will be adjusted to include gold coins purchased at the end or beginning of each year.

You should also check the minimum investment amounts for each gold coin. While some companies will require you to invest more money in order to sell you gold coins, others will only allow you to spend as little as PS1. It all depends on your financial resources and what you are willing to invest.

Last but not least, consider the safety and security of purchasing gold coins. Many people worry about losing their hard-earned cash to fraudsters. This problem can be avoided by buying gold coins from reputable firms. Verify that the company you’re dealing with is registered and a member the British Bullion Association. You should also be cautious about purchasing gold coins online due to the many scam sites.