Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

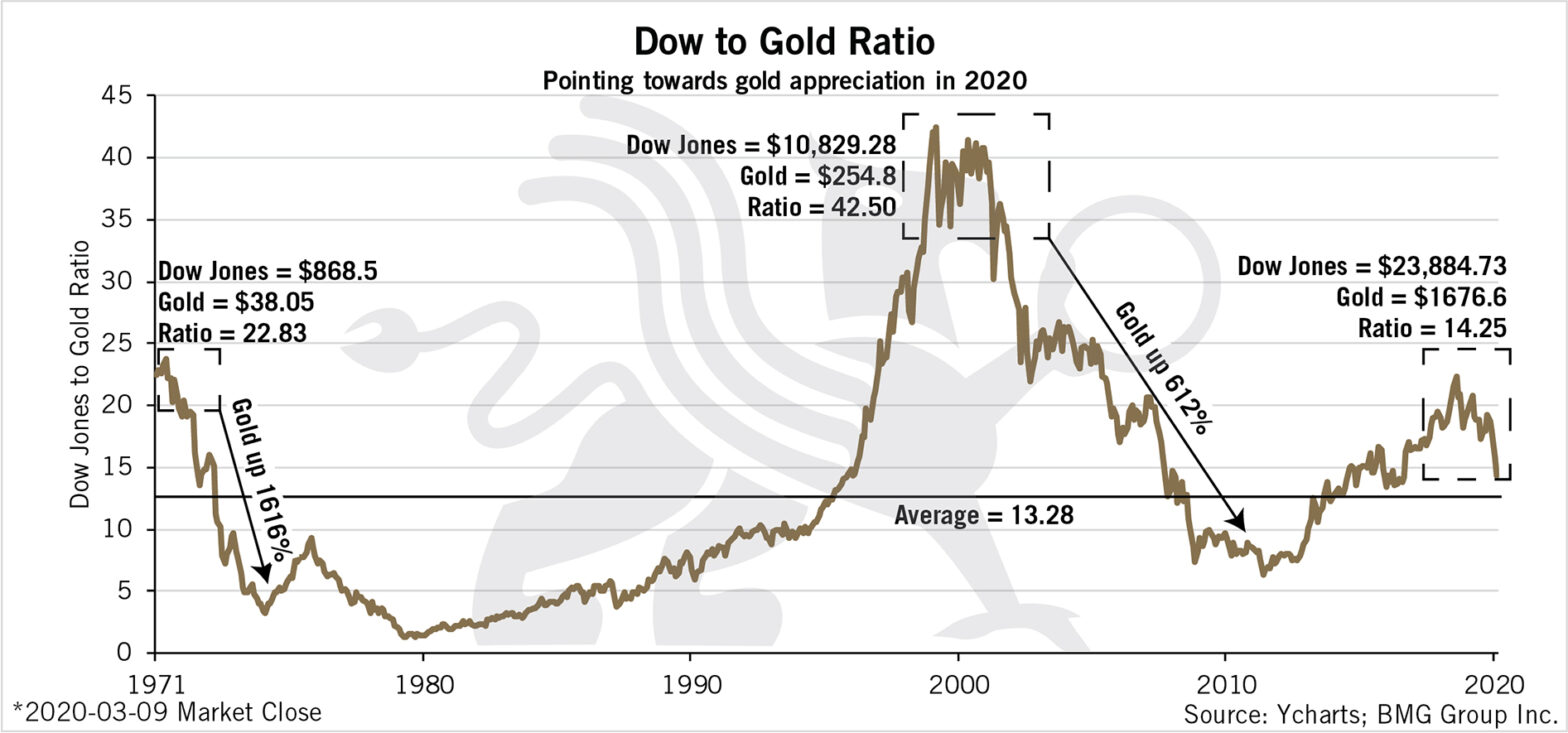

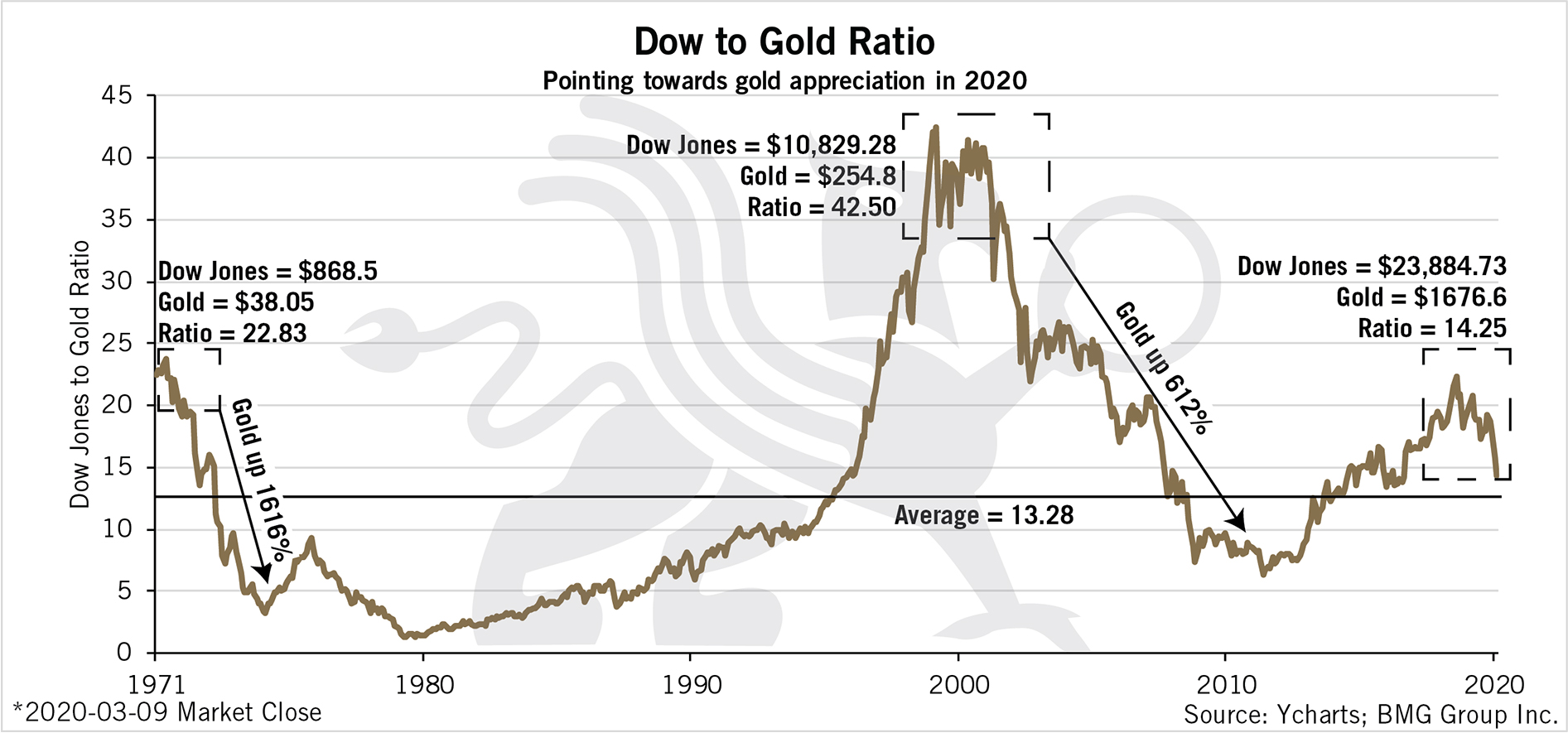

Gold ratios, like the Dow/Gold ratio, have been one of the most popular ways to analyze the stock market in recent years. They are a powerful tool that can allow investors to gauge how much value is in an investment. By comparing the price of a stock to its value in gold or platinum, investors can quickly and easily assess if a stock is a bargain.

Dow/Gold ratio

The Dow to gold ratio is the number of shares of the Dow Jones Industrial Average that an investor could theoretically buy with one ounce of gold. It is calculated by dividing the total value of all Dow Jones stocks by the price of an ounce of gold.

The ratio’s value has fluctuated widely over the years. The historical average is about 15:1, but it has reached highs of 40 during the dot-com bubble of 2000 and lows of 1.0 in 1980.

This ratio can be a good indicator of whether a stock market is overvalued or undervalued. If it is overvalued, the market may be over-extended. A lower ratio indicates a market that is undervalued.

The Dow/Gold Ratio has a long history, but has been on a major decline since 2006. Gold has been outperforming the Dow for more than a decade. Some analysts suggest that this is the precursor to another major bull market.

Gold-to-silver ratio

When it comes to trading, there are a lot of different tools and indicators you can use to help you make the right decisions. One of the most common tools is the Gold-to-Silver Ratio. This ratio is calculated by dividing the price of gold by the price of silver.

Historically, the ratio has fluctuated a great deal. Early in the twentieth century, it was a relatively balanced ratio. However, it was a much higher ratio in the 1970s and early 1980s. The rise in inflation and debt encouraged many to invest in precious metals.

Since the end of the Gold Standard in the 1970s, the gold to silver ratio has become very volatile. It has ranged from a low of 30 to a high of 100.

There are many factors that have influenced the ratio. One of the major contributing factors is the discovery of silver in the Americas. Another is the United States’ attempts to shape the prices of precious metals.

Gold-to-Platinum ratio

Gold to platinum ratio is an important indicator for gold and platinum prices. It can help investors identify which metal is best for them. In addition, it can be a good indicator of the state of the economy.

Platinum has historically traded at a premium to gold. However, in recent years, platinum has been trading closer to gold than it has in the past. This is due in part to the fact that gold is a safe haven investment and is considered a hedge against inflation.

If the platinum price is higher than the gold price, it suggests that the global economy is deteriorating and a risk off stance is taking hold. This is likely to lead to a rise in the price of gold. On the other hand, if the platinum price is lower than the gold price, it is a sign of a possible recession.

Historically, gold and silver have performed well during times of economic growth and monetary stability. However, there have been several times in the last few years where both of these precious metals have taken a beating.

Silver-to-gold ratio in a bounce pattern with RSI and MACD positive divergences

Gold and silver are both experiencing strong growth over the last few weeks. This is because of the rising sentiment surrounding precious metals. These investments have also risen in many other markets.

For example, the Dow has climbed to new all time highs. The S&P 500 has increased by 5,200%. It’s clear that the US economy has finally begun to show solid growth after years of ZIRP. A breakdown of the gold-commodities could have inflationary implications.

The gold-silver ratio has been trading in a potential bounce pattern for several months. If it breaks out, it’s likely to coincide with a broad market bounce. During this period, the USD has been consolidating and could even experience a counter-trend bounce.

Several key indicators suggest that a sovereign debt crisis is approaching. This will lead to an increase in safe haven assets such as gold and silver. Ultimately, the Fed could eliminate currency in circulation en masse.

Frequently Asked Questions

Is it a good idea to have gold IRAs?

It all depends on who you ask. If you are just starting, they may be a good way to build wealth over time. There are better ways to put your money if you have an established business.

For example, you could start a business. This gives you more control than buying gold coins from an IRA.

You may also want to consider selling some of the gold coins you have and investing the proceeds into stocks or bonds. This would enable you to diversify the portfolio.

If you plan to retire early, an IRA can be a valuable asset. Once you reach retirement age, you can withdraw your assets from your IRA without paying taxes.

However, this does not mean that only one type can be used to buy gold coins. Other types of accounts offer different investment options. You could open a stock brokerage and trade shares. You can also set up an online banking account and start making withdrawals and deposits.

How does a gold IRA earn money?

It can make money investing in gold. Every year you earn interest on the amount that you have in gold. There are no fees involved with owning gold in an IRA.

How do you buy gold coin for an IRA

It is essential to know what amount of money you have (or which type of account it is) in order to buy them. A bank might offer to sell $10,000 worth physical gold coins if you don’t want to use cash. Your employer may allow you to withdraw money from your 401k if you have a pension plan. Direct rollovers are usually free. The IRS requires that any withdrawals made directly into a retirement plan must be made by purchasing physical gold coins.

You could also transfer funds directly into a traditional IRA from another investment account if you have a traditional IRA. This is called self-directed, and although it’s not mandatory, most people prefer to do so. Your financial advisor will help you to determine which accounts you want to transfer the money. Then your advisor will take care of transferring the money over to your IRA.

You can also purchase physical gold coins using online platforms such bullionvault.com/coinbase.com These online platforms act as intermediaries between buyers and sellers, and they charge fees. They store the coins until they are purchased by someone, then they deliver them to the buyer upon payment.

Statistics

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. (forbes.com)

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

- But like gold coins, you’ll probably be paying extra for the amount of gold you’re getting—a premium that could be anywhere from 20% to 300%, depending on the manufacturer. (forbes.com)

External Links

investopedia.com

jmbullion.com

forbes.com

How To

How and why to buy gold coins

The safest investment for any type is gold coins. The main reason behind this is that they are very stable and provide great returns if you buy them at the right price. There are many options for gold coins, making it difficult to decide which one you should buy. We will show you how to select the right gold coin for your investment portfolio.

First, you should consider the amount of money you want to invest. It might not be a good idea to buy gold coins if you have limited funds. It might be wise to invest in gold coins if your budget is large. Gold coins offer higher returns than any other form of investment. To avoid losing out on future potential gains, it is a good idea to start small.

Next, think about what return you would expect to get from investing in gold coin investments. There are two types main gold coins. They are paper gold certificates or physical gold. While physical gold coins consist of actual gold bars and paper gold certificates, they are only pieces of paper representing some kind of value. It is important to look for gold coins that offer a high rate of return. This means that you need to look at the market prices for gold coins and compare them with their historical rates. You could, for example, use this formula to find out how many years it would take to return your initial investment.

Number of years Initial Investment / (5% x number of years)

If you know the required years, you can decide whether or not it makes sense to buy gold coins now. Please note that the above equation assumes gold coins are bought at the beginning and end of every year. The calculation will be adjusted to include gold coins purchased at the end or beginning of each year.

You also need to verify the minimum investment amounts of each gold coins. Some companies will require higher amounts to sell gold coins while others may allow you as low as PS1. This is dependent on your available budget and your willingness to spend.

You must also think about the safety of purchasing precious metal coins. Many people are concerned about the possibility of losing their hard-earned money to fraudsters. This problem can be avoided by buying gold coins from reputable firms. Be sure to verify that the company dealing with you is registered and that they belong to the British Bullion Association. Avoid buying gold coins on the internet as there are many fraud websites.