Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

Buying a 10 oz bar of gold is an excellent way to secure your money. It is a great way to store your money and will help you get through hard times. You can also buy gold bullion online to help you store your money securely.

Silver is a better place to put your money

Investing in silver is a good way to diversify your portfolio. Physical silver offers the same benefits as gold without the risk of depreciation. Unlike gold, physical silver is not subject to counterfeiting or counterparty risk.

When it comes to buying silver, you should start by considering your personal preferences. Some people prefer buying coins, while others prefer buying bars. There are also many different investment options for buying silver.

Investing in physical silver is a good way to store wealth during economic uncertainty. It is easy to buy silver coins or bars through your local bank, investment broker, or through an exchange-traded fund.

Investing in silver is a good idea for small investors. It is easy to store and it is a more versatile investment than gold. The price of silver is also much lower than the price of gold.

Silver is a good place to put your money because it is not volatile like gold. It is also easier to sell small amounts of silver than gold. The value of silver is determined by supply and demand.

The value ratio of silver to gold

During the last couple of years the gold:silver ratio has been rising steadily. However, it hasn’t yet hit new highs. It’s presently hovering around 80 ounces of silver for every one ounce of gold. This means that silver is undervalued.

Historically, silver has been more valuable than gold, but the ratio has changed drastically over the last couple of decades. In 1979, silver to gold ratio hit an all-time low of 15:1, and rose to 100:1 in 1991. However, during the global banking crisis of 2007 and 2009, silver sank and the ratio climbed to a high of 80:1.

However, in recent years, the ratio has bounced back and forth between 80 and 50:1. It’s a common myth that gold is a hedge against inflation, but it doesn’t have to be. If interest rates increase, silver will be more valuable. However, silver has more industrial uses than gold, and is expected to grow as the economy recovers from the recession.

Buying gold bullion online

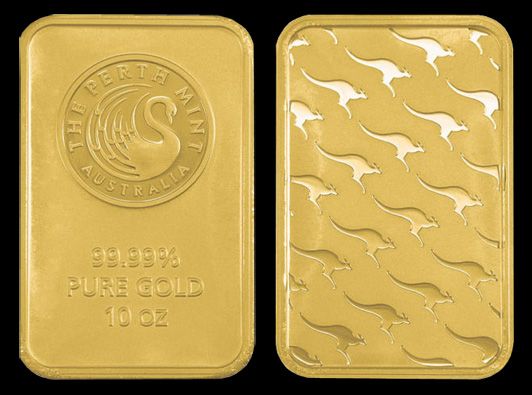

Purchasing a 10 oz gold bar is a great way to get into the gold market. It is also a good way to diversify your portfolio and get your money into a safe place. It is an excellent form of storage that can be purchased from a variety of different mints and refiners. It is also one of the smallest gold products, so it can be stored just about anywhere.

You can find gold bars of all shapes, sizes, and designs. Some gold bars have unique designs, but they all have the same basic qualities. The gold content in the bar should be 99.5% or more. You should also look for the hallmark, or the stamp, that tells you who manufactured the bar.

It is important to select a gold dealer that has an excellent reputation and is known for providing quality service. You should also make sure that you are working with a gold dealer that can advise you on your investment decisions.

Precious metals dealers store and secure precious metals differently

Buying a 10 oz bar of gold can be a lot easier than you think. However, storing and securing the metals is a little different from the way you’re used to. You should be aware of the risks involved, so you can make an informed decision.

One way to store and secure your gold is to keep it in a safe at home. You should also consider how you’ll transport it. If you have a lot of it, you may want to get a secure vault to store it in. If you only have a few pieces, you can store them in a small safe at home.

While you’re researching gold dealers, be sure to read customer reviews. The reviews will let you know whether the company has a good reputation or not. Reputable companies will have many customer reviews, as they’ve been around for a while and have earned trust through numerous transactions.

Another way to store and secure a gold bar is to purchase it online. You can get the product shipped to your home in a nondescript box. However, you should be sure to make your purchase insured and be sure to receive a signature upon delivery. Some vendors also offer buy-and-store programs, which allow you to purchase your gold online and then pick up your items at the store.

Frequently Asked Questions

What tax is gold subject in an IRA

You can deduct any investment expenses, including taxes, associated with property like stocks or bonds from your income. In addition, you can deduct interest payments on loans that were used for business purposes.

This includes qualified dividends (capital gains), and losses. If your deductions exceed $3,000 annually ($1,500 if married filing independently), then you can’t deduct them.

This deduction must be claimed every tax year. These losses can be carried over into future years, if you are experiencing a loss. However, losses cannot be used to offset profits from another year.

How do I buy gold coins for an IRA

Because there are many ways to buy them, it is important to know how much money and what type of account you have. For example, if you want to use cash, you would ask a bank to sell you $10,000 worth of physical gold coins. You may be able to withdraw from your 401(k) if you have a retirement plan. This is known as a direct rollover and it is usually completely free. The IRS stipulates that withdrawals to a retirement account must be made through physical gold coins.

If you have a conventional IRA, it is possible to transfer funds directly into a IRA. This is called self-directed, and although it’s not mandatory, most people prefer to do so. This is done by contacting your financial advisor. Tell him/her what accounts you want the money to be moved into. Your advisor will then help you transfer the money to an IRA.

Online platforms, such as bullionvault.com/coinbase.com, can be used to purchase physical gold coins. These online platforms act as intermediaries between buyers and sellers, and they charge fees. They hold the coins until someone buys them and then deliver them to the buyer once payment is received.

Why Gold Storage Is Important?

A bullion bank is the best place to store gold because it offers security and safety.

They have been keeping precious metals safe for thousands of year and have proven their worth over time. They also provide great services such as insurance coverage which protects you against losses due to theft.

These companies will securely store your gold. They will also pay interest to you and protect it from theft.

How do you buy and safely store gold?

Always keep gold in a safe deposit container at a bank. It is preferable to keep your precious gold at your home. This will make it difficult to retrieve quickly in times of emergency. Fireproof safes, which are the most widely used type of safe deposit boxes, are the most preferred. Banks use them to protect their valuables from theft. A fireproof safe can be used to store your precious metals. They can be costly. An alternative is to purchase a basic safe deposit box from your bank. These boxes are less expensive than $100 per annum. In addition to being affordable, they offer additional security features like keyless entry.

You could also store your precious metals at a reputable dealer. Most dealers offer storage services for free, so there’s no need to worry about where to store your precious metals after you buy it. Some dealers even offer discounts for multiple items.

If you plan on storing your gold at home make sure it is in a safe place. It is important that no one gets in the room where you have placed your gold. Make sure no one else has the keys to the room. If someone has keys, make sure to change the locks right away.

If you decide to store your gold in a bank, ensure it is insured by the Federal Deposit Insurance Corporation (FDIC). All deposits above $250,000. will be covered by the government if your bank goes under.

How do I put gold in my IRA?

It is best to buy precious metals directly from the mining companies. This saves you money and gives you total control over how much you own.

An Individual Retirement Account (IRA), is the most common investment vehicle for precious-metal ownership. If you’re under 59 1/2, you can save money tax-free. These funds can be used at retirement if they have grown in value.

Fidelity Investments, a well-respected company, should open you an account. You will find a wide range of account options, including Gold IRAs. They also provide mutual fund options that allow you to diversify your portfolio of investments. These mutual fund options are great for starting to invest in precious Metals. It makes it easy to buy shares of stock and then sell them without getting into debt.

After opening an IRA, you can decide whether to purchase bullion in physical form or certificates of deposit. Since it will keep its value even during economic downturns physical bullion can be considered the most secure option. CDs can be less stable than bullion. However, they are not nearly so secure.

Certificates of deposit (CDs), are available in two forms: interest bearing and not-interest bearing. However, interest-bearing CDs have higher returns and require you to hold the cash for longer. However, they are less risky and safer than non-interest-bearing CDs.

Statistics

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

- That’s almost a 5% markup over a comparable amount of gold bullion. (forbes.com)

External Links

nytimes.com

- The New York Times: Safe Deposit Boxes aren’t Secure – The New York Times

- Where Is All That Gold Being Stored? (Published 2020)

royalmint.com

investopedia.com

How To

How to Invest Physical Gold

When investing in physical gold, there are several things to consider. While physical gold is generally cheaper than investing directly in stocks, bonds, or real estate it is still very expensive. You should ensure you know what you’re doing before investing your money. These are some suggestions to help you get started.

- Choose a reputable dealer who sells only certified coins. You should only deal with bullion bars if they are selling them. You will need a Certificate of Authenticity. This indicates that it was made out of gold and contains its serial number. The COA should also contain the weight and purity information.

- Look at the price history of the type of gold you want. The spot price per ounce of gold is a good way to see if it is rising or falling. It is possible to also view the price per kilogram, which is the cost of one gram. This is helpful because most people prefer not to count grams but weigh their gold.

- Consider whether you believe the gold price will rise or fall. It is difficult to predict the direction of the gold price, so it’s best to not get attached to any particular price range. You can still find coins made recently if you feel the price will go up. Coins produced years ago tend to be worth less now because they haven’t increased in value very much.

- Purchase something with a low number of mintages. The mintage is used to determine the coin’s rarity. One billion coins have been produced, so the U.S. Silver Eagle has a mintage number of 1,000,000. This means that 10 million coins are only produced every year. This means that if you want to buy rare coins, your next silver dollar won’t cost you nearly as much.

- The condition of the coins is important. It is unlikely that you would want to spend thousands of money on jewelry that has signs of wear. Also, jewelry that shows wear should not be purchased if it’s intended to be used as an investment.

- You should inspect the condition of your metal. You’ll notice that a lot of gold bars don’t look smooth when you purchase them. That’s because most gold isn’t pure gold. Instead, it contains impurities such as copper and nickel. For proof that your gold is pure, request a certificate of analysis. This document includes the percentage of each element in the gold.

- Don’t buy anything you can’t afford to lose. Even if you aren’t planning on spending tens of thousands on an item, you shouldn’t put all your eggs in one box. You could lose a lot if you decide to sell the item after you have already spent a lot.

- Keep track of your purchases. Make sure that you keep records of everything you buy. You will be able to avoid regretting buying something if you keep these records.

- Avoid dealing with private sellers. Many websites offering low prices are scams that attempt to lure buyers. Before making a deal, always ask for references. Don’t send money outright away.

- Avoid online auctions. Online auctions can be very lucrative. However, some sites may offer incredible deals while others charge high fees. Be sure to know exactly what you are paying before you bid.

- Learn how to store your items. While most precious metals can withstand temperature changes, some jewelry and coins require special storage.

- Take care when buying from overseas. For gold, many countries do not require proof of authenticity. Many unscrupulous people will profit from unsuspecting foreign customers.

- Understanding the difference between bullion rounds and bars is important. Bullion bars contain solid pieces. Rounds contain very little gold. They’re lighter and more transportable than larger bars.

- Pay attention to the fine print. Clear terms and conditions should be included in any contract. You might be able to find clauses that allow sellers to withdraw from the sale of the item once payment is made.

- Never accept money for gold. Cash transactions are risky, especially if you’re dealing with people from other countries.

- Do your research. You might consider selling the item at a higher price if you purchase something at a great price.

- Beware of scams Many websites advertise cheap gold prices. However, they are often trying to trick you.

- Get expert advice. If you feel taken advantage of or don’t understand something, seek legal advice.

It is wise to invest in gold. It is a timeless investment that has held its value for hundreds of years. When investing in gold, it is important that you are careful. There are many options for investing in gold. Make wise decisions!