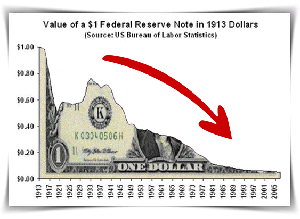

For some time, it seems that people around the world have taken notice of gold as an investment. Some look at it as a hedge against inflation. While others realize that gold has never been worth zero – which of course cannot be said about fiat currency (like, the US Federal Reserve Note).

Why Invest In Gold? Here’s Why…

- All Paper Currencies Fail

- Central Banks Have Been Heavily Buying Gold Since 2009

- Billionaires Are Buying Gold

- The Buying Power Of Your Dollar is Shrinking Everyday

Why are Central Banks and Billionaires buying gold?

Because they know something most people don’t.

If you’re considering investing in gold and researching where to buy gold online, you’re among the smart people who are considering alternatives to where they place their money, both for investing and safekeeping. We live in an economy filled with uncertainty, especially regarding our finances and the monetary policies that govern how we spend our dollars. What was once only predicted by naysayers (the collapse of the banking system), we’ve all seen or experienced in recent years. Thousands losing all or significant portions of their investments, except those that had a nest egg in gold has proven beyond a shadow of a doubt that investing in gold, is simply a smart method to protect your investment.

Click through to find out about the official gold website

Inflation’s Effect On Gold…

The term “hedging against inflation” is one of the most important factors concerning why you should invest in gold. Inflation and the rate at which we borrow money continue to rise, as governments create additional currency (running the money presses) without real value behind this paper. The ownership of gold protects against the financial uncertainties of life and world governments. Each time that more money is printed then added to the supply, the purchasing power of all money decreases; we’ve all experiences this when we goes the market, by gasoline, or seek bank loans.

Based on financial sources, inflation is hovering around the 4.2% level, however that figure is an average and certain goods have left that number far in the distant past. While it’s true that certain items have seen a decrease in price, such as electronics, using an across-the-board average, inflation continues to rise with no end in sight. The savvy investor no longer wonders whether they should invest in gold they now know they must invest in gold; it is simply a smart and forward thinking way to diversify their holdings. This fact can easily be seen since statistics prove the average person spends a greater part of their income on the very things most subject to inflation. These include food and housing for our families, gasoline for our vehicles, and higher education for our children. Looking specifically at these parts of the economy, we see an inflation rate above 10% and continuing to rise.

Why invest in gold?

Investing in gold is a guaranteed way to insure your future against the capriciousness of the financial markets, the possibility of bank collapse. Gold has proven itself across thousands of years, and those historical facts are just if not even more true today. Gold is and always has been in short supply, based on this fact its value cannot be inflated as we do with paper currency. Gold remains tried and true, and while the cost of gold has risen significantly in recent years, the purchasing power of an ounce of gold remains tried and true. Why invest in gold, it’s simply a smart way to protect your future against the whims of the world economy.

This doesn’t mean that gold can’t be used as an investment, especially true today when countries such as India, China, and Russia, place demands on the gold supply, causing the value to skyrocket. As people worldwide continue to lose confidence in the paper economy, gold is poised to continue its stratospheric climb. As this is written in the price of gold hovers around $1300 an ounce, and while this makes an ounce of gold a significant investment, it is still considered a sound and savvy investment, since the price of gold could increase to $2000 or more over time.

Want to find out how to safeguard your investments against inflation? Click through to check out this Gold dealer

Why Invest In Gold?

“All currencies eventually go to zero. But, gold has never been worth zero over the last 5,000 years.” ~ Mike Maloney (Precious Metals Expert)

To summarize, the smart investor who wants to protect themselves against inflation should invest in gold for the following reasons:

- Loss of confidence in the world’s banking system

- The US dollar continues to depreciate

- Inflation continues to rise making simple surviving in today’s economy difficult for many

Gold is not something simply precious in America, Canada, or the UK, gold is a precious worldwide. Why invest in gold, because gold is a universal “store of value”, which can be used in any country and is not tied to a particular government. Gold also is simple to understand, easy to store, and an asset, that is not tied to the world’s political climate.

And, of course you should invest in gold as a way to diversify your holdings, providing peace of mind in an uncertain world.

Click through to find out about the official gold website

Storing Gold

Gold can be stored in your home, safe deposit boxes, or other secure locations, providing peace of mind knowing your nest egg will never lose value. With millions having lost their retirement nest eggs, those who invest in gold have the security and peace of mind of knowing they have secure options no matter how the global economy is faring. Investing in gold is like standing on a peaceful island, in the midst of a raging storm, in this case an uncertain financial storm.

Buy Gold Online From A Trusted Source

You’ve probably already heard stories of certain gold dealers selling counterfeit gold bars and coins. To avoid being ripped off by scam artists, your best bet is to buy gold online from one a trusted gold dealers…GoldCo. They have:

-

- An “A+” Better Business Bureau rating

- A 5-Star Trust Pilot Rating

- A 5-Star Google Rating

- A 5-Star TrustLink Reviews Rating

- Are a registered member of Ethics.net

- Are Consumer Affairs Accredited

Filed Under: Why Invest In Gold

#Gold #BuyGold