Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

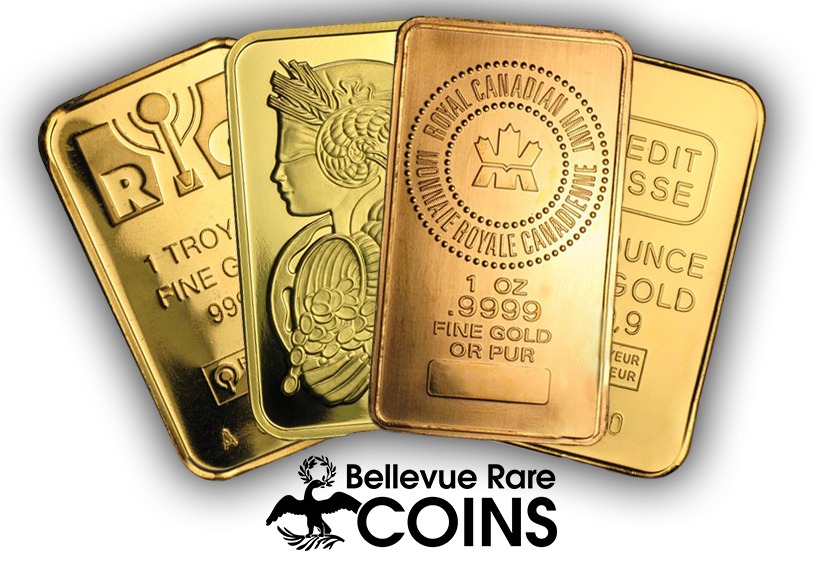

Purchasing a 1 oz gold bar can be a great way to start off with the precious metal. It can help you build your savings and get started on a secure investment. There are a few things to consider when you’re buying one of these bars. You’ll want to know how to select a good one, and where to find it. You’ll also need to consider the different types of gold bars that are available.

Perth Mint

Investing in a Perth Mint 1 oz gold bar is a safe and easy way to get a taste of the pure gold bullion. Whether you are interested in investing in gold for the first time or are an experienced investor, Perth Mint’s gold bars are the perfect way to get a piece of Australia’s golden heritage.

Perth Mint gold bars are made from 24 karat gold. They feature a unique swan logo, which pays tribute to Australia’s enduring symbol.

These bars are produced from the highest quality metal and come with excellent security features. They are guaranteed by the Commonwealth Government of Australia and are eligible for use in Precious Metal IRAs.

Perth Mint gold bars are available in a variety of sizes, including 10g, 5g, and 1g. They are also available in multiples of 25 bars. Each bar is individually numbered, and each bar is individually packaged in a tamper-evident assay card.

Credit Suisse

Investing in gold has always been a great way to protect yourself against economic trends. Today, you can invest in gold bars with the peace of mind that they will provide a secure hedge against inflation. Credit Suisse gold bars offer an excellent value, which makes them an excellent choice for investment.

Credit Suisse is a global financial organization that was founded in 1856 to help connect Switzerland with neighboring European nations. Since then, the company has expanded to over fifty countries. It is considered one of the world’s leading financial institutions.

Credit Suisse is a trusted fabricator of gold bars, and their products are federally authenticated pre-market. This means that buyers have proof of the authenticity of the assayed bar, as well as the composition of the bar.

Royal Canadian Mint

Whether you are looking for a new addition to your portfolio, or looking for a gold bullion investment, the Royal Canadian Mint 1 oz gold bar is a great choice. It is produced by one of the world’s most reputable mints, and is known for its craftsmanship. Featuring unmatched purity and superior security features, this gold bar offers an excellent value for your money.

The Royal Canadian Mint produces a wide range of bullion products, including gold bars. They are known for their quality craftsmanship and design, and are one of the most popular gold bars in the world.

Each bar features a unique serial number, as well as the mint’s signature. A laser-engraved security mint mark is also included. It is visible under magnification, and serves as a unifying element.

Scottsdale Gold

Located in Scottsdale, Arizona, Scottsdale Mint produces high quality silver and gold bullion. Scottsdale Mint is known for its responsible sourcing of precious metals. The company is also renowned for its innovative bullion designs.

The company produces a number of attractive 1 oz gold bars. The company logo, a lion, is found on several of the company’s gold bars. The company also produces silver bullion, which includes a variety of hammered and engraved designs. The company uses recycled silver from the photography industry to produce its products.

The company’s most notable lion head logo features a bushy mane and a large crown. It also includes the words “Scottsdale Gold” engraved below the lion’s head. The logo also includes an assayer’s mark.

Sizes of 1 oz gold bars

Whether you are new to the financial markets or a seasoned investor, 1 oz gold bars are a great addition to your investment portfolio. The smaller size of these bars makes them easy to store and transport. They are also highly sought after by investors because they carry huge amounts of value. They are also easier to forge than larger gold bars.

There are a number of companies that produce 1 oz gold bars. The most commonly produced are manufactured by the world’s largest refineries. One example is Perth Mint, which is among the largest in the world. These companies manufacture brand new 1 oz gold bars.

Each bar is stamped with a unique serial number. Each bar also comes with an assay card. This card explains the gold bar’s purity and its origins. Using an assay card is important for buyers because it helps to ensure the quality and authenticity of a gold bar.

Frequently Asked Questions

How much does it run to store gold at a bank

It costs banks 1 million dollars annually to keep all this gold safe. This is why banks charge for gold storage at the bank.

There are many ways you can protect your savings from theft, and other disasters. An insurance policy protects your money from being stolen. You could also buy gold bullion. Gold bullion can be described as a physical money. It is real because it is believed to have real value.

Banks store gold bullions as legal tender. They aren’t just kept in vaults; they are also used to create jewelry. You can even find them in shops around world. Gold bullion can be stored anywhere you want. You have gold at all times.

Your financial advisor is the best way for you to decide how much gold to invest. He’ll tell you what options are available and help you decide whether investing in gold makes sense for you.

What is the benefit of a gold IRA?

People with large amounts of capital can use gold IRAs to safely invest in safe investments without paying taxes on any gains.

The best part? You don’t have to worry about getting into trouble because the IRS will make sure these accounts follow the rules.

An IRA that is gold allows you to not only invest in physical Gold but also other precious metals such silver or platinum.

You could for instance, buy one ounce in gold and then add a few ounces to it. This would give you about 20 ounces in gold and 10 pounds of silver.

If you’d rather, you can invest in just gold. It is simpler to track holdings for many investors.

Gold IRAs are also beneficial because they make it possible to diversify your assets. You could, for example, invest your savings in gold and keep some money in stocks or bonds.

This is especially important if you are planning on retiring soon as it will protect against inflation.

How does an IRA in precious metals work?

You can use a precious metal IRA (PMIRA), to invest in physical bullion silver, gold, platinum, or palladium coins. There is no income tax on these investments. You can also purchase shares in the companies producing these physical products. The shares are then held by an independent custodian in trust until they mature.

You can sell the assets and receive the cash proceeds tax-free. Capital gains tax is also not applicable due to the asset’s appreciation.

While a PMIRA is similar in nature to stock ownership, it offers greater diversification due to the fact that you own tangible assets and not financial instruments. This is because you are not exposed to stock exchange fluctuations. It is also less risky.

The IRS requires you pay ordinary income tax on dividends received from these investment choices. However, if you qualify for the Gold Individual Retirement Account (IRAs), you won’t have to pay any federal income taxes on the earnings from these accounts.

Selling precious metals may result in you having to pay state income tax. These taxes may vary from state one to state. Ask your accountant and tax advisor which state you should be filing your returns.

How do I put gold in my IRA?

The best way to invest in precious metals is by purchasing them directly from mining companies. This eliminates the need for middlemen and allows you to control how much gold you have.

Individual Retirement Accounts (IRA) are the most popular form of investment for precious metal ownership. If you are less than 59 1/2 years old, it allows you to save money taxes-free. These funds can be used at retirement if they have grown in value.

You should open an account with a reputable company such as Fidelity Investments. You can choose from a variety of accounts including Gold IRAs. They also offer mutual fund options to help diversify your portfolio. These mutual fund options are great for starting to invest in precious Metals. It makes it easy to buy shares of stock and then sell them without getting into debt.

Once you’ve opened an IRA, you’ll need to decide whether to purchase physical bullion or certificates of deposit. Since it will keep its value even during economic downturns physical bullion can be considered the most secure option. While CDs are more stable than bullion, they aren’t nearly as secure.

Certificates of deposit (CDs), are available in two forms: interest bearing and not-interest bearing. While interest-bearing CDs offer higher returns, they require that you keep your cash invested for a longer time. Non-interest-bearing CDs are safer and less risky, although they don’t pay as high of a return.

How is gold taxed within an IRA?

The IRS allows you deduct investment expenses, such as taxes, from your income. Interest paid on loans for business purposes may also be deducted.

Qualified dividends, capital gains and losses are all included. These deductions cannot be taken if they exceed $3,000 per annum ($1,500 for married filing separately).

This deduction must always be claimed in each tax year. You can carry these losses into the following years if there is a loss. However, losses cannot be used to offset profits from another year.

Statistics

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- That’s almost a 5% markup over a comparable amount of gold bullion. (forbes.com)

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

External Links

investopedia.com

forbes.com

jmbullion.com

How To

Best Gold IRA Companies: Top Gold Investment Retirement Accounts for 2022

The best gold investment retirement accounts for 2022

You can use your money to invest in gold without worrying about taxes and other fees. You can buy shares in stocks, bonds, commodities, real estate, etc. Our calculator will show you how much you can earn.

Many ways can you invest in precious metals including gold, silver palladium, platinum and palladium through Gold IRA companies. They offer their clients a safe place for their wealth, as well as tax advantages and low transaction charges.

Precious metal IRA investments offer many benefits. These investments provide diversification and protection from traditional assets, such as bonds and stocks. Diversifying your portfolio ensures that if one asset drops in value, another won’t suffer. These investments also tend to be resilient during economic downturns. This means that when things get really bad, you still might come out ahead compared to someone who invested in a volatile stock market.

Another benefit of investing in precious metal IRAs is that they often pay higher interest rates than conventional savings accounts. You could earn $100 more per month by investing in precious metals.

Precious Metal IRA companies usually don’t charge sales commissions so there are no hidden fees. A minimum account balance is not required. So, whether you decide to open a new account or transfer existing funds into a new IRA, you should find plenty of opportunities to save.

You should ensure that you have qualified plans if you want to take advantage the federal government’s tax-free status. You can contribute pretax dollars to a Roth IRA through one of two qualified plans – 401 (k)s or 403(b). However, only 401(k) plans let you withdraw your contributions after age 59 1/2 without paying additional taxes.

To invest in precious metal IRAS, you don’t need to wait until retirement. Many people use their employer IRA to invest precious metals as it defers taxes. Your employer doesn’t place limits on how much money you can contribute, unlike regular IRAs.

Many employers will match your contribution. Employers that match your contributions may allow you to increase your savings by thousands every year.

What are you waiting to do? It’s easier than ever to invest in precious metal IRAs.