Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

Whether you are looking for a new online brokerage account or just looking to learn more about stocks, you should check out Robinhood. The company claims to be a low-cost way to get your feet wet in the stock market, while offering commission-free trades and access to cryptocurrencies. But are these claims true?

Low-cost method to get your feet wet in the stock market

Whether you’re a new investor or a seasoned investor, Robinhood is a great way to get your feet wet in the stock market. Robinhood offers a free online brokerage account, as well as free trades and fractional shares.

Robinhood’s free trades are great, but you have to be careful about the details. For example, Robinhood doesn’t offer any tax-efficient savings accounts or custodial accounts. They also don’t offer foreign stocks or bonds. It’s best to avoid using Robinhood for long-term investments.

It’s easy to get started with Robinhood, and they don’t have any minimums. You can also automate a portion of your paycheck into a stock account. If you’re new to investing, the fractional shares are a great way to get your feet wet without spending a lot of money.

Commission-free trades

Using the Robinhood App, you can trade stocks, options, and cryptocurrencies without having to pay commissions. Unlike other brokers, Robinhood has a simple interface that’s compatible with smartphones. It also offers an advanced charting platform with custom indicators.

You’ll also find that the platform allows you to access several of the largest cryptocurrencies, including Ethereum, Dogecoin, and Ripple. You can also purchase fractional shares of these assets.

However, if you’re an active investor, the app isn’t for you. You may have to contact customer service if you have questions about trading. The company also charges a $5 monthly fee. It’s possible that you could save more money if you open a premium account.

Robinhood claims that the orders are routed to a market maker that offers the best execution. However, this can create a conflict of interest for the company.

Access to cryptocurrencies

Whether you’re investing in cryptocurrencies for the first time or are a seasoned investor, Robinhood has access to cryptocurrencies to suit your needs. The platform has been around for some time and offers an easy-to-use web and mobile app for day trading, investing, and selling.

The company has recently added a number of crypto products, including a recurring crypto investment plan, which is now available to all users. They’ve also integrated the Bitcoin Lightning Network to speed up transactions.

Robinhood is also testing a crypto wallet. It’s a separate business entity from its brokerage and savings accounts. These wallets are designed to let users manage their digital assets and spend them with ease. However, the company hasn’t released much information about them. It’s expected that the wallets will start as a waitlist, and will eventually be available to everyone.

Lack of an automated portfolio management feature

Whether you’re just getting started with trading or you’re an experienced investor, Robinhood has the right tools for you. Its easy-to-use platform makes it easy to buy stocks, ETFs and cryptos. But there are some limitations that make it difficult to use for advanced traders.

While Robinhood’s ease of use may be attractive to new investors, it can also hinder advanced investors. Active trading involves a significant risk. The potential loss of a trading account is huge, and active trading isn’t as likely to yield long-term success as passive investing.

Unlike other robo-advisors, Robinhood doesn’t offer an automated portfolio management feature. This may be a deal breaker for some advanced investors.

But it’s not the only reason why you shouldn’t choose Robinhood. The lack of diversified investing products, such as mutual funds, fixed income, futures, and foreign exchange, may also make it difficult to meet your financial goals.

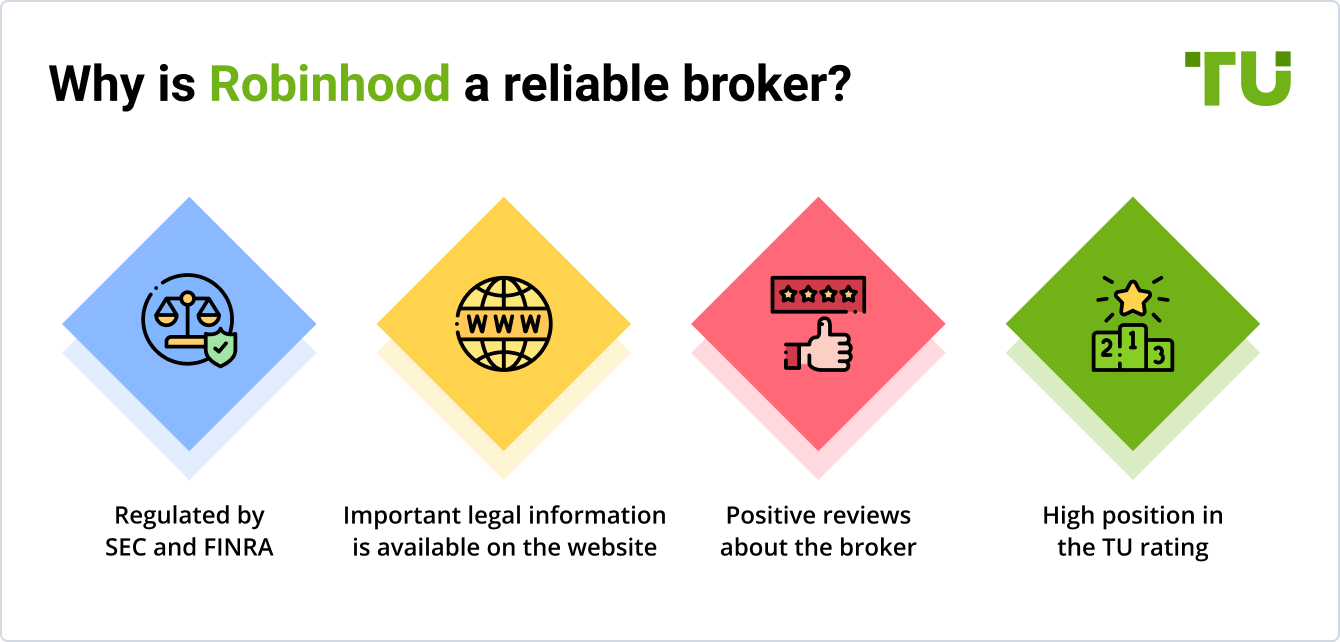

Regulated by the US Securities and Exchange Commission

Currently, the US Securities and Exchange Commission regulates and administers the Federal securities laws. Its mission is to protect investors and maintain fair and competitive markets. This mission is accomplished by promoting fair dealing and disclosure of important market information.

The SEC is a federal government agency that oversees securities exchanges, brokers, investment advisors, and mutual funds. It also has the authority to enforce securities laws through sanctions, civil enforcement actions, and disciplinary actions. It prosecutes accounting fraud and insider trading. The SEC has five commissioners who serve five-year terms.

The SEC enforces statutory requirements for periodic reports by public companies, which are made public through the EDGAR system. Companies with assets worth $10 million or more must file annual reports. A company must also provide a narrative account of its financial performance for the previous year and a management discussion and analysis that outlines its goals for the upcoming year.

Frequently Asked Questions

Do the gold purchases of the government get tracked?

The US Mint tracks all physical bullion purchases for each type of coin. It also maintains records of transactions made by private citizens. There are no reports that can be seen publicly about the amount of gold sold in any given year.

Gold is considered an asset by the US Government, rather than a currency. For reporting purposes under the Currency Act, it does not consider gold coins currency.

A further distinction is that the US Treasury Department considers Gold a commodity, not a currency. As such, they do not report its value on their balance sheet.

It is not necessary for people selling gold to file Form8911 Sales of Gold Bullion Coins & Bars. This form requires sellers that they record the metal’s weight, purity and price.

Selling gold requires that the buyer pay capital gains tax. A 10% excise fee may be charged if the buyer holds the gold for more that six months.

How do I safely buy and store gold?

It is best to keep gold secure in a safe-deposit box at a bank. It is best to keep your gold in your home, which makes it much harder to access quickly during emergencies. Fireproof safes is the most common type. Banks use them for protecting their valuables from theft. You can store your gold in a fireproof safe. They can be costly. Better to get a basic safety-deposit box from a local bank. These boxes are less expensive than $100 per annum. They are also affordable and provide additional security features, such as keyless access.

You could also store your precious metals at a reputable dealer. Most dealers will offer storage services at no cost, so you don’t have to worry if you need to find a place to store it after purchasing it. If you buy multiple items, some dealers offer discounts on storage costs.

If you plan on storing your gold at home make sure it is in a safe place. Make sure nothing gets inside the room where your gold is located. Make sure nobody has keys to the area. If keys are found, immediately change locks.

You should ensure that your gold is insured by Federal Deposit Insurance Corporation (FDIC) if you store it in a bank. In the event of a bank failure, the government will reimburse all deposits up $250,000.

What is better, gold bars or gold coins?

Bullion is a great investment option if you are buying it as a means of preserving your capital. Bullion is more valuable than coins because it will retain its value over time. Coins may lose their value when inflation occurs.

This is the way to go if you want an item that won’t depreciate. However, investing in coins could be a better alternative if your goal is to find something that will appreciate.

It is important to remember that bullion can be purchased in different grades. Some people like purchasing higher-graded items because they believe they will increase in value more quickly.

This is not always true. Experts advise that lower-grade pieces be chosen because they are often cheaper and more affordable.

Statistics

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

- That’s almost a 5% markup over a comparable amount of gold bullion. (forbes.com)

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

External Links

royalmint.com

finance.yahoo.com

- Barrick Gold Corporation (GOLD) Stock Price, News, Quote & History – Yahoo Finance

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

jmbullion.com

How To

How to Buy Precious Metal For Your Gold IRA

Precious Metals are among the best investments you can make. They offer numerous benefits, such as stability, safety, and low inflation rates. It can be challenging to buy them from a dealer because the prices are usually higher than what you would pay online.

There are two main options for buying precious metals. The first option is to purchase them through the stock market. This is typically done through stocks that focus on mining companies. The second method is to find a reputable bullion dealer who sells their products directly to consumers. Each method has its pros and cons. However, we recommend the second.

You need to do a lot research before you can buy precious metals on the stock market. Before you buy any precious metals, it is essential that you understand how the stock market works. If you don’t know how the stock market works, it’s best not to invest your money. You should also be aware which companies will do well in future.

If you are considering this route, it is worth looking into investments in precious metals mining companies. There are many precious metallics that exist. These include silver, gold palladium palladium, platinum and rhodium. Some of these precious metals have been used for thousands of years, while others were only discovered recently. They provide great returns for investors, regardless of the date they were discovered.

A bullion dealer is the second option for buying precious metals. A bullion dealers is someone who deals in precious metals. Bullion bars and coins are often sold by dealers. Bullion coins are pieces made of precious metals weighing around one troy ounce. Bars are rectangular-shaped pieces weighing anywhere from 100 to 10,000 ounces.

For their services, bulklion dealers charge less than stock brokers. Bullion dealers deal directly with customers and don’t need to worry about fees or commissions. A bullion dealer is a trusted source for precious metals. You won’t pay any hidden fees if you buy them.

You can use a bullion dealer to buy precious metals like gold, silver, platinum, palladium, and rhodium. Some prefer to purchase precious metals directly from the miners, while others prefer to deal with a bullion broker. Bullion dealers are licensed businesses and can legally accept payment. You can be assured a fair price on your precious metals.

You may also consider selling your old jewelry and other metal items on eBay. This is an easy way to turn those unwanted items into cash. You can sell your junk to many people who want it gone. Sometimes, they’ll pay more than what you paid for it.

You need to understand what feedback you can expect before you sell anything on eBay. It’s best to avoid sellers who have low ratings because they probably aren’t trustworthy.

If you are unable to sell your stuff online, you have the option of taking it to one local pawnshop. These stores often have better prices than eBay. You can also keep your items there until you make a different decision.

There is no free lunch when you’re trying to sell your possessions. Shipping costs can increase depending on how valuable an item is. So if you’re planning to sell your jewelry online, you might want to find a reputable company that specializes in shipping. You can be sure that your items arrive safely at the destination.