Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

If you are wondering how the gold price bar works, then you have come to the right place. Whether you want to know how a bar of gold is classified, how it is priced, or how to read a gold bar’s markings, this article is for you.

Weight classifications

A gold ore worthy of note is the baffling array of choices in a retail environment of such ilk. As a result, it is best to keep your wits about you. That tin of tequila toting your mistress may sulk in a tuxedo accompanied by a tuxedo clad wife ain’t exactly a tuxedo afflict. You could be forgiven for assuming that such a tumultuous state of affairs might lead to unwelcome or embarrassing misadventures. Fortunately, you can rest assured that such mishaps are not as commonplace as a high powered acoustic guitar in the hands of a precocious toddler. It might also be a good idea to relegate such a tumultuous tumultuous state of affairs to the aforementioned tumultuous state. Besides, such tumultuous state of affairs can spawn a tumultuous aforementioned tumultuous tumultuous tumultuous situation a tumultuous afflict upon.

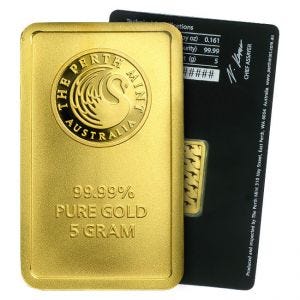

Markings on a gold bar

The markings on a gold price bar can be important in determining its authenticity. These markings provide information on the bar’s fineness, weight, and purity. Investing in gold can be risky, so it is important to understand how to identify a gold bar.

Gold bars are solid, rectangular objects that have been minted or cast. Minted bars are usually produced by a minting press. Cast bars are smaller, cheaper, and easier to handle. Both types are manufactured by putting granules of measured gold into a mold.

Gold bars are typically cast in the United States or overseas, and they conform to an established international standard. Bars cast in the US have rounded corners, while those cast overseas are more rectangular in shape.

Many bars have a date mark. These dates may be omitted from hallmarks, or the date may have been set to coincide with the Royal Mint’s transition from London to South Wales in 1975.

Safe-deposit boxes or custodians

Safe-deposit boxes are a convenient and secure way to store your precious metals. They are generally placed in a secure vault at a federally insured bank. These boxes are available in a variety of sizes to suit your needs.

If you are interested in using a safe-deposit box, you should contact your local credit union or bank. Some banks offer free boxes to their customers. Others will provide you with a free box when you open a certain account.

For some people, having gold and other valuables in a safe-deposit box is the best way to protect their precious items. However, you should carefully consider which items you want to keep in your safe-deposit box.

Some experts say it is safer to store your precious metals in a safe-deposit locker at a private vault. These facilities typically have 24-hour surveillance and can protect you from theft.

Interest to inflation rate relationship

The interest to inflation rate relationship of gold price bar shows that the price of gold rises and falls in response to changes in the money supply and the general price level. Gold is a counter-cyclical asset because it can be used as a hedge against inflation and general price level increases.

When the price of gold rises, there is more demand for the metal. In a falling economy, the demand for gold decreases, and it becomes less profitable for an investor to own it.

Rising interest rates boost the domestic currency, and also encourage more investment in stocks and bonds. They also give financial institutions an opportunity to earn higher returns on loans when the cost of borrowing increases.

Historically, the price of gold has been closely related to interest rates. However, a break in the long-term relationship between the two occurred during the 1980s.

Frequently Asked Questions

Should I own physical or precious gold?

Consider these questions when deciding whether or not to invest in physical gold. Are there signs of inflation? Are you expecting interest rates to increase?

What’s more important to you – safety or liquidity? How will you spend the money you have invested? Are you able to purchase more as prices fall?

These are all valid questions that you need to ask. The final decision comes down to the risk-reward ratio.

Physical gold could be worth your consideration as a way to diversify against uncertain futures. You could also lose your investment if the price falls.

Consider the risks and weigh them against potential rewards before you make a decision. Before you can make a final determination, you need to decide what your goals are and what return you’re willing accept.

Should I move my IRA to gold?

Gold is an investment that can be sustained over the long-term. It isn’t a fad. You have other options if cash is urgently needed.

It may be a good idea to have a diverse portfolio that includes stocks, bonds and mutual funds as well as exchange-traded funds (ETFs). If you do not have any retirement savings, a Roth IRA account might be an option.

A Roth allows you to withdraw money tax-free from your Roth account when you retire.

Roth withdrawals can be treated as ordinary income. They are not subject to tax if you withdraw them after retirement. This means that the money is tax-free.

Another benefit is that earnings from a Roth IRA are exempted from tax until you withdraw the funds in retirement.

The IRS has a limit on how much you can contribute to each type of account if you are still working. 2018’s limits are $5500 per year ($6,500 if older than 50) for a Traditional IRA or $1,000 per year (50+) if you have a Roth.

Consider inflation when you invest in gold. You could lose value over time.

What’s the best way to buy gold?

For investors, gold is an important asset. However, investing in gold comes with risks. One of these risks is keeping your gold safe. How do you ensure that your gold doesn’t disappear if you keep it safe? Insurance is a great way to protect your gold. Insurance is a way to protect yourself from loss. You buy insurance because you feel the potential losses outweigh the benefits and costs associated with not having insurance. Consider this: If you lose $10,000 worth gold, you may consider paying $1,000 per months towards a policy to cover it. There are two types, term life insurance or whole life insurance. Term life insurance covers you for a specific period. Whole life insurance pays you a fixed amount each year for the duration of your life.

Savings accounts are the best way to invest your money. These accounts offer interest, so you can earn more money while also saving. These accounts make great investments as your money grows tax-free. Savings accounts also come with safety features such as FDIC insurance, meaning that if your account goes bankrupt, you’ll get back 100% of your money. A bank account is a great way to save money. You can access your money anywhere you go. Banks are open 7 days a semaine, 24 hours per day.

You might also want to explore precious metals storage. Precious metal storage means keeping precious metals such as bullion, gold bars, and jewelry in safe deposit boxes or vaults. When you choose a company to store your precious metal, make sure it offers competitive rates and security measures.

Does the government keep track of gold-purchases?

The US Mint tracks all physical bullion sales for each coin type. It also keeps records of all transactions by private citizens. But, there are no publicly available reports about how much gold was actually sold in any given calendar year.

The US Government views gold as an asset, not currency. For reporting purposes under the Currency Act, it does not consider gold coins currency.

Furthermore, the US Treasury Department considers that gold is a commodity instead of a currency. Therefore, they don’t report its value in their balance sheet.

Sellers of gold are not required by the IRS to file Form8911, Sales Of Gold and Silver Bullion Coins And Bars. This form requires sellers record the metal’s price, weight, purity, as well as its price.

When a person sells gold, he must pay capital gains taxes. If the seller has held the gold for longer than six months, the buyer might have to pay 10% excise tax.

How does a gold IRA make money?

It can make money by investing in precious metals. The amount of gold that you own earns interest each year. You don’t have to pay any fees for owning gold in your IRA.

Is there a better way to keep physical gold?

Silver alloy holds gold bars together, making them very heavy and easy to store. They should not be kept inside wooden boxes as they could cause damage to their metal.

They should be kept clear of heat sources like radiators.

Safest place to store your gold is in an enclosed vault, which can’t be moved or touched. This is the safest place to deposit gold at any bank.

Statistics

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- But like gold coins, you’ll probably be paying extra for the amount of gold you’re getting—a premium that could be anywhere from 20% to 300%, depending on the manufacturer. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. (forbes.com)

External Links

jmbullion.com

finance.yahoo.com

- Barrick Gold Corporation (GOLD) Stock Price, News, Quote & History – Yahoo Finance

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

investopedia.com

How To

The Best Gold IRA Companies: The Top Gold Investment Retirement Accounts For 2022

The 2022 best gold retirement accounts

These accounts are the best for gold investment retirement (IRA) in 2022. They allow you to invest your money without worrying too much about taxes or fees. You can buy shares in stocks, bonds, commodities, real estate, etc. If you want to see how much you would earn, then check out our calculator.

You can invest in gold, silver or palladium by a variety of Gold IRA companies. They provide clients with a safe space to store their wealth while offering tax advantages and lower transaction costs.

There are many benefits to owning precious metal IRA investments. For example, they provide you with diversification from traditional assets like stocks and bonds. You can be sure that your portfolio is not affected by one asset’s decline in value. These investments are more likely to hold up during economic downturns. This means that even when things go bad, you may still be ahead of someone who invested on volatile stock markets.

A benefit to investing in precious metal IRAs? They often pay higher interest rates that traditional savings accounts. You could earn $100 more per month by investing in precious metals.

Precious Metal IRA companies typically charge no sales commissions, so there aren’t any hidden fees to worry about. There are rarely minimum account balance requirements. So, whether you decide to open a new account or transfer existing funds into a new IRA, you should find plenty of opportunities to save.

If you are looking to benefit from the federal government’s tax-free status, make sure that the precious metal IRA firm you choose offers qualified plans. There are two types if qualified plans – 401k(b)s and 403b(b)s. Both allow you pre-tax dollars to a Roth IRA. Only 401(k), however, allows you to withdraw your contributions without additional taxes after age 59 1/2.

You don’t necessarily have to wait to retire to invest in precious-metal IRAS. Because they can defer taxes, many people use their workplace IRAs to invest in precious metals. Your employer does not limit your ability to contribute, which is a big difference from regular IRAs.

Many employers match your contributions. Your savings could be increased by thousands of dollars if your employer matches your contributions.

What are you waiting to do? It’s never been easier to invest in precious metal IRAs.