Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

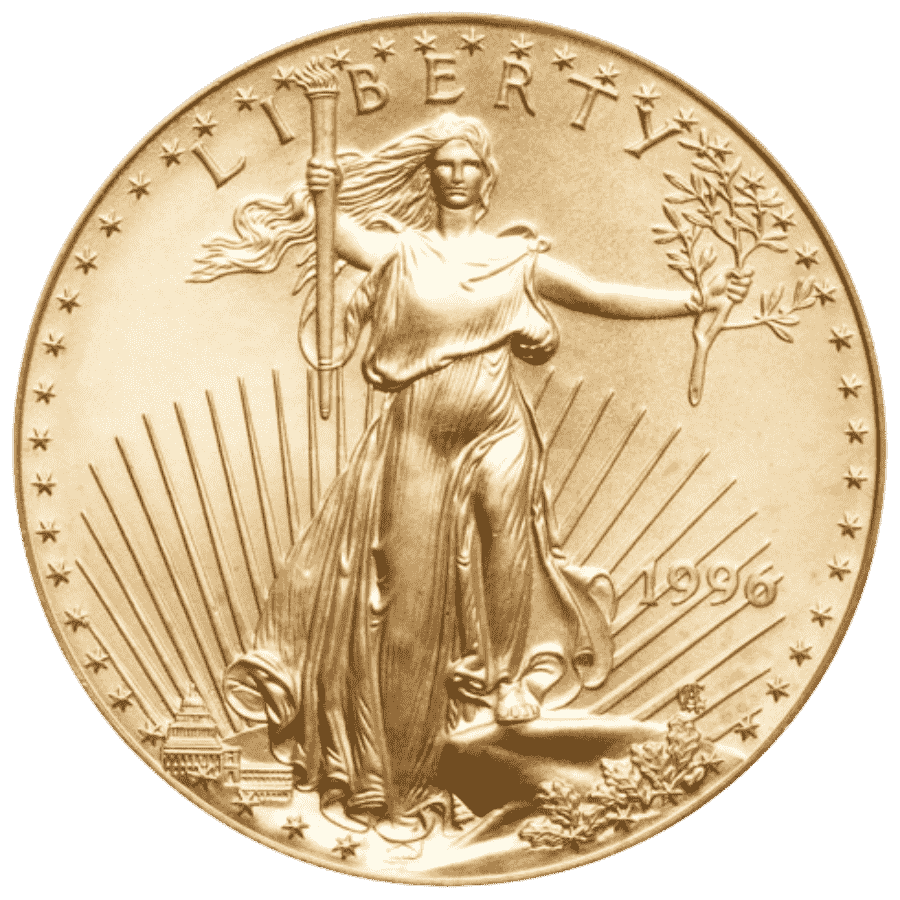

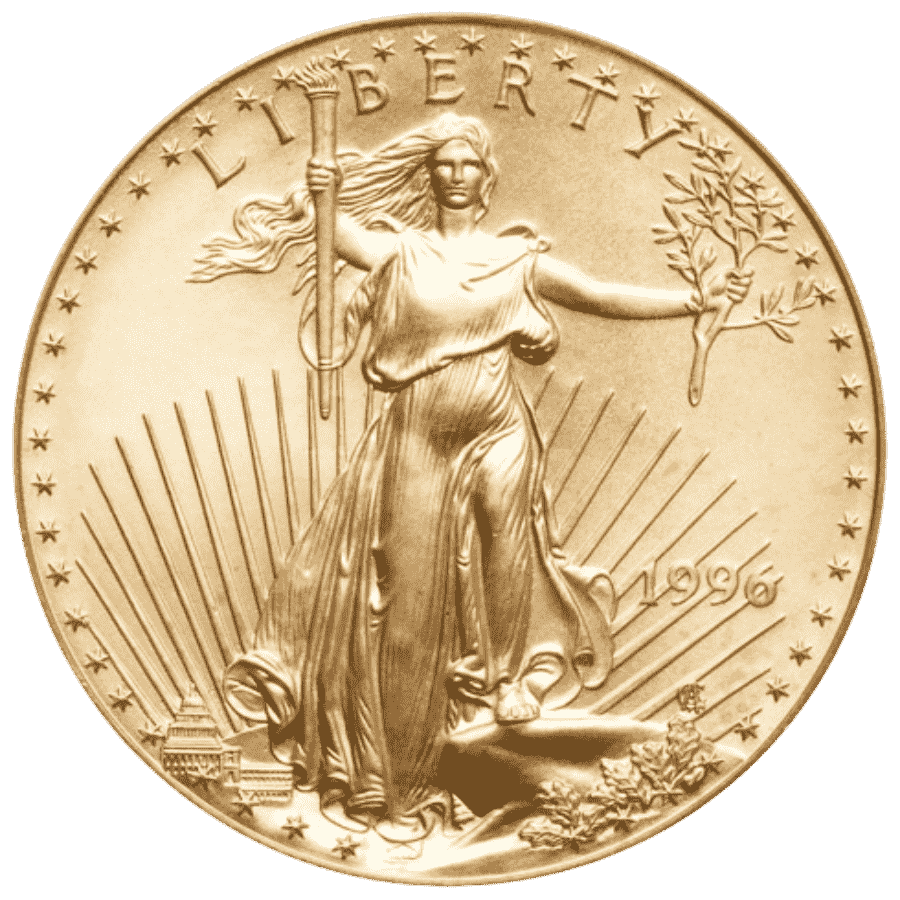

The 1 oz American Eagle gold coin is a great way to buy your own precious metal. While this coin has been minted to ensure the security of the US Dollar, its value is based on the metal it contains rather than its denomination. You can get this coin in proof or uncirculated conditions. It also has a legal tender status, meaning that you can exchange it for something in the US.

Proof

The Gold American Eagle Proof 1-oz coin is one of the most popular gold bullion coins in the world. This popular collectible is guaranteed by the U.S. government and is available in any year.

The proof version of the coin consists of one troy ounce of pure 22-karat gold. It is produced by the United States Mint. In addition to the bullion version, there is also a collectible version of the coin.

These coins feature frosted relief devices. They are also noted for the mirror-like finish that creates a striking look.

The reverse design features a male eagle carrying an olive branch. He is surrounded by the words “E PLURIBUS UNUM” and “IN GOD WE TRUST.” On the obverse side of the coin, Lady Liberty carries an olive branch in her left hand and a torch in her right hand. She is also surrounded by state stars.

Uncirculated

If you’re looking for a great gift for a numismatist or a budget-conscious investor, you should consider purchasing an Uncirculated American Gold Eagle. They are produced by the United States Mint and are backed by the US government. The gold coins come in four different sizes and are issued with legal tender face value.

The obverse side of the coin features an image of Lady Liberty, designed by Augustus Saint-Gaudens. She is surrounded by state stars, and the word ‘Liberty’ is engraved above her head.

The reverse side of the coin has a close-up portrait of an eagle. The eagle holds an olive branch, which is a symbol of peace. It also contains the year of issue in rays around its head.

Value is tied directly to the metal it contains rather than its denomination

American Gold Eagles are some of the most popular coins in the world. These gold bullion coins are minted in the United States. They are a great way to diversify an investment portfolio.

The face value on an American Eagle is usually higher than the actual value of the coin. This is referred to as the “intrinsic value” of the coin.

The intrinsic value of the coin is based on the price of gold, but is not directly tied to the face value of the coin. This is important because the actual value of the American Gold Eagle is much higher than the face value.

The intrinsic value of the coin is also based on the value of the metal it contains. A bullion coin is worth more than its face value because the metal content is higher than the coin’s weight.

Legal tender in the US

The 1 oz Gold American Eagle coin is a bullion coin with a guaranteed gold weight. It is minted by the United States Mint. It is one of the most popular gold bullion coins in the world.

This coin is designed by Augustus Saint-Gaudens. It features a family of bald eagles on the obverse. On the reverse, the United States of America is shown.

This coin was authorized by the Gold Bullion Coin Act of 1985. It is one of the few American coins that have legal tender status in the United States.

This is because the US government guarantees the purity, weight, and content of the coin. There is also a face value. These coins are not intended for use by merchants. Rather, they are purchased as an investment and a way to protect against inflation.

Hedge against the perpetual devaluation of the US dollar

One way to hedge against the ongoing devaluation of the US dollar is to buy gold bullion. These coins are available in one ounce, one-quarter ounce and one-half ounce sizes. They are guaranteed by the US Mint to be at least 99.99% pure gold. While it may seem like a bit of a leap of faith to invest in something that can be easily converted to dollars, the rewards are well worth the cost.

The first order of business is to locate a certified mint dealer in your jurisdiction. Not all coins are created equal. For instance, if you are looking to invest in silver, you might want to steer clear of coins minted in China. A quick online search will give you a list of authorized dealers in your area.

Frequently Asked Questions

How much gold do I have to keep at home

Average people keep around $500 worth gold at home. If you are looking for an investment opportunity you might consider bullion bars. These bars are solid metal pieces that contain real gold. They could be sold to make more money.

You should only invest in something that makes sense for you. If you are unsure where to begin, consult a financial planner. They can help determine the best investments for you.

What is the tax on gold in an IRA

You can deduct any investment expenses, including taxes, associated with property like stocks or bonds from your income. Also, interest paid on loans made for business purposes can be deducted.

This includes qualified dividends (capital gains), and losses. If your deductions exceed $3,000 annually ($1,500 if married filing independently), then you can’t deduct them.

This deduction must always be claimed in each tax year. These losses can be carried over into future years, if you are experiencing a loss. However, profits from another year cannot be used to offset losses in one year.

Can I buy Gold with my Self-Directed IRA?

This question will vary depending on whether you are an investor or have another type of retirement account (401k/403b, 457) at your workplace. You can check your paperwork to find out what type of retirement plan it is. You may also want to contact your financial advisor for help determining which plans are available to you.

If you don’t already have a retirement account, you should consider opening a Roth Individual Retirement Account. You can make tax-free contributions to a separate account, which you can access from your regular paycheck. Then when you retire, you can take money out of your account without paying taxes until you withdraw it.

Roth IRAs are a part of estate planning strategies. You can put your money into your Roth IRA. Because you don’t pay income taxes on earnings within the account, inheritance tax will not be due to your heirs when you pass away.

How much does gold storage in a bank cost?

It costs banks 1 million dollars annually to keep all this gold safe. You will be charged for the storage of your gold at a bank.

But if you want to protect your savings from theft and other disasters, there are many ways to do that. An insurance policy will protect you against losing your money. Or, you could purchase gold bullion. Gold bullion can be described as a physical money. It has real value because people agree that it does have value.

Gold bullions are stored by banks as legal tender. They are used for jewelry making and not just stored in vaults. You can even find them in shops around world. It doesn’t matter where you store your gold bullion. You have gold at all times.

Talking to your financial advisor can help you determine how much gold should be invested. He’ll tell you what options are available and help you decide whether investing in gold makes sense for you.

How does an IRA with precious metals work

A precious metal IRA (PMIRA) allows you to invest in physical gold, silver, platinum, and palladium bullion coins without paying income taxes on the profits from these investments. You can also acquire shares of companies that produce the products. Once they mature, an independent custodian holds them in trust.

When you sell them, you receive cash proceeds tax-free as well as any capital gains tax due to the appreciation of the value of the assets.

A PMIRA is similar to owning stocks but provides greater diversification because you own tangible assets instead of financial instruments. It’s also less risky than investing directly in equities since you’re not exposed to stock market fluctuations.

The IRS requires you to pay ordinary income taxes on the dividends received from these investment options. You don’t have federal income tax if you’re eligible for the Gold Individual retirement account (IRAs).

You may also be subject to state income taxes when you sell precious metals. These vary from state to state, so check with your accountant or tax advisor to determine what state(s) you should consider filing your returns in.

Why Gold Storage Is Important?

The key reason why people should store gold at a bullion bank is that they are safe and secure.

They have been keeping precious metals safe for thousands of year and have proven their worth over time. They also provide great services such as insurance coverage which protects you against losses due to theft.

These companies will keep your gold safe when you give them permission. They will also pay interest to you and protect it from theft.

Where can I store my IRA Gold?

An IRA account that holds gold is not recommended as it can cause you to lose control over how much you have.

Taxes are also required to access your funds.

If you are storing your gold for investment purposes, you might consider other options, such as mutual funds from precious metals.

What is the best way to invest in gold?

Since its discovery, many have chosen gold as their preferred investment.

While it’s easy to sell and buy gold, there is some risk involved.

An investment in precious metal funds that invest in physical gold and silver bullion is the safest option.

Statistics

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

- Gold purity is calculated based on karats, with 24 karats being 100% gold. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

- Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. (forbes.com)

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

External Links

forbes.com

nytimes.com

- The New York Times: Safe Deposit Boxes aren’t Secure – The New York Times

- Are All the Gold & Silver in Storage? (Published 2020)

investopedia.com

How To

How and why to invest in gold coins

Gold coins are considered one of the safest investments for any type of investment. Their stability and high returns are the main reasons for this. There are many types of gold coins and it is easy to get lost in the sea of choices. Below we explain how to choose the best gold coin for your investment portfolio.

The first thing you need to do is determine how much you can afford to invest. If you only have a small budget, buying gold coins might not make sense. If you have a lot of money, buying gold coins might make sense. They offer greater returns than other investment options. To avoid losing out on future potential gains, it is a good idea to start small.

Next, you must consider what kind of return you expect from investing in gold coins. There are two types main gold coins. They are paper gold certificates or physical gold. The physical gold coins are made of real gold bars. Paper gold certificates are pieces of paper that have some value. It is important to look for gold coins that offer a high rate of return. It is important to compare historical rates of return with the current market price of gold coins. The following formula can be used to determine how many years it will take to recoup your initial investment if gold coins give you a return of 5% per annum.

Number of Years Initial Investment / (5% x Number Of Years)

Once you have a clear picture of the required years, it will be easier to decide whether buying gold coins right away is worthwhile. Note that the equation assumes that you purchase gold coins at the start of each year. If you buy your gold coins at year’s end, you will need to add another year.

You also need to verify the minimum investment amounts of each gold coins. Some companies require large amounts of money to purchase gold coins. Others will let you invest as little at PS1. This is dependent on your available budget and your willingness to spend.

You should also consider the safety involved in purchasing gold coins. Many people are concerned about the possibility of losing their hard-earned money to fraudsters. Buy gold coins only from reputable companies to combat this problem. Be sure to verify that the company dealing with you is registered and that they belong to the British Bullion Association. Also, be careful about buying gold coins over the internet, as there are too many fraudulent websites online.