Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

If you are planning on purchasing a Krugerrand you will want to consider the value of your coin. There are several ways to find out how much your coin is worth. These include the weight, the mintage, the gold content and the numismatic value.

Gold content

The Kruger Rand is a gold bullion coin that is minted by the South African government. It is named after the former President of South Africa, Paul Kruger.

The Krugerrand was introduced in 1967 by the South African Mint as an opportunity for private investors to buy and hold gold. At the time, private ownership of gold bullion was illegal in the United States.

In addition to being a popular investment vehicle, the Krugerrand is also known as a legal tender in South Africa. Unlike other coins, the Krugerrand does not have a face value. Rather, the value is derived from its metal content and gold content.

The Krugerrand has a weight of one troy ounce and is made of a copper-gold alloy. This gives the coin an orange-gold tint and durability.

Weight

The Krugerrand is one of the most famous coins in the world. It is made up of a gold-copper alloy, ensuring that it is durable and long-lasting.

The Krugerrand was first minted in 1967. Initially, there was no face value, but the coin is considered legal tender in South Africa. In addition, the coin is not particularly scarce.

There are four denominations of the Krugerrand. One is a quarter ounce, which weighs 22mm. Another is a half ounce, which weighs a little more than a quarter of an ounce. Lastly, there is a full ounce, which weighs over a tad over an ounce.

Each of these coins has its own special features. For example, the proof versions are produced in smaller quantities and carry a premium. These special coins also have a mirror finish. They are made with specially polished dies.

Numismatic value

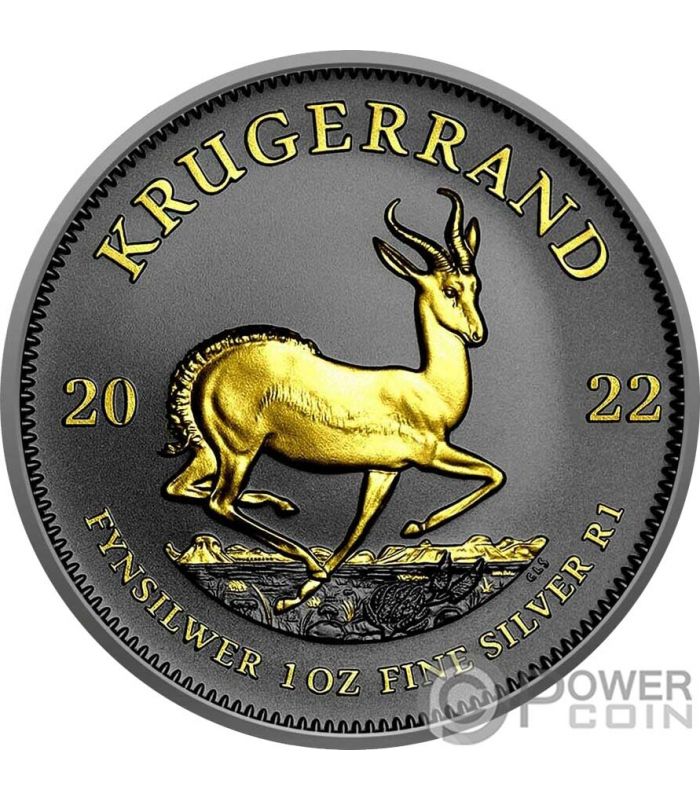

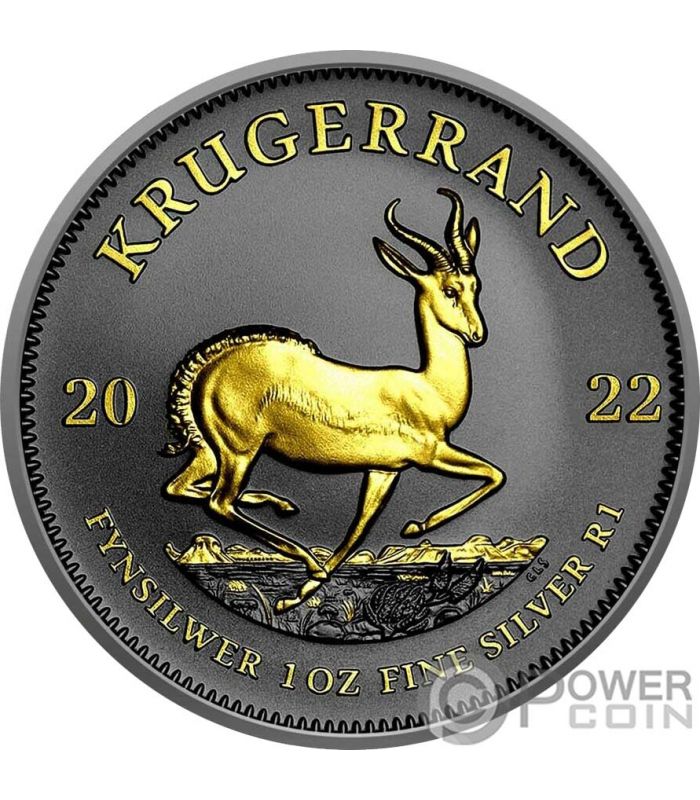

Krugerrand is a coin issued by the South African Mint. It was introduced in 1967 as a means of private investment. The obverse design features an image of the country’s national animal, the Springbok. On the reverse, the image of Paul Kruger, the Boer statesman, is surrounded by words “KRUGERRAND”.

The coin has a high metal content. This gives it a high value. Besides the metal content, its fineness also affects its value. A higher fineness means a higher numismatic value.

A collector’s gold Krugerrand is available in addition to standard bullion editions. These coins feature special handling and design elements that give them extra numismatic value. Some are dated and have privy marks.

There are hundreds of different types of Krugerrands. These vary in size and issue. They are a popular item among numismatic enthusiasts.

Mintage

The first gold Krugerrand coins struck in 1967 were made by the South African Mint. This bullion coin is modeled after the British Gold Sovereign and the Canadian Maple Leaf. They feature a reverse design featuring the Springbok Antelope.

There are a wide variety of issues for the Krugerrand. During the heyday of the coin’s production, up to 40 million one-ounce coins were minted. However, the demand for these coins declined over the course of the 1980s and 1990s.

Some of the most sought-after Krugerrand coins are underweight-proofs. These are very rare and are sold at premium prices. In addition, they contain less gold than they should. You can spot them if they show an off-center strike and if they do not have any privy marks.

Buying gold with a Krugerrand

Buying gold with a Krugerrand can be a safe and convenient way to store your precious metal. This small coin carries a value that is based on its pure gold content. The Krugerrand has been a popular investment vehicle for many years.

When the South African government first issued the Krugerrand in 1967, it was considered a new type of modern bullion coin. It was intended to help encourage private investment in gold.

The design of the coin was inspired by the image of springbok, the national animal of South Africa. The obverse side features the face of Paul Kruger, a former Boer president.

The reverse side of the coin features the profile of a springbok antelope. The coin is made from two parts copper alloy to give it a distinctive orange-gold glow.

Frequently Asked Questions

How does a Gold IRA make money.

It makes money investing in gold. The amount of gold that you own earns interest each year. Gold in an IRA does not come with any fees.

Should I store gold at home?

Keep your gold safe at home if you are buying it for investment purposes. You don’t need to store it if you buy it for investment purposes. It’s just another form of money.

Can gold coins be held in an IRA?

Investments in IRAs are not permitted for gold coins. Their collectibles are not allowed by the IRS.

The gold coins are property and can’t be put into an IRA account.

However, you can still hold gold coins for your personal use.

IRAs are designed to give investors tax-free income over time. So long as you follow the rules, the IRS won’t interfere with your ability to save. However, you should understand that keeping gold in your IRA will decrease the capital available for other investments.

This is generally a good thing. As the market increases, so does the price of gold. Your holdings will lose value if gold prices fall.

Keep in mind the risks of keeping your gold coins inside your IRA. First, you must know how much of your gold you have. Next, you will need to determine the gold’s value. The last step is to determine if there are enough funds to cover possible losses.

You might have to sell your investments to make more money if you don’t have enough cash. You might have to liquidate some of you retirement savings in order to pay off your debts.

Once you are confident that you have sufficient cash, you can purchase gold coins.

Is it possible to buy gold using my self-directed IRA

The answer to this question depends on whether you are an individual investor or have any other type of retirement account (401k, 403b, 457) at work. You should check your paperwork to confirm what type you have. You may also want to contact your financial advisor for help determining which plans are available to you.

If you don’t already have a retirement account, you should consider opening a Roth Individual Retirement Account. This allows tax-free contributions to a separate, tax-exempt account that you can use as a source of income from your regular salary. Once you are done with your regular paycheck, you can withdraw money from the account without paying any taxes.

You can use your money in your Roth IRA as part of your estate planning strategy. You don’t have to pay income taxes on your earnings so there won’t be any inheritance tax when you die.

Statistics

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- But like gold coins, you’ll probably be paying extra for the amount of gold you’re getting—a premium that could be anywhere from 20% to 300%, depending on the manufacturer. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

- For instance, a one-ounce American Eagle coin is only 91.67% gold. (forbes.com)

External Links

nytimes.com

- The New York Times says safe deposit boxes aren’t secure

- Are All the Gold & Silver in Storage? (Published 2020)

finance.yahoo.com

- Yahoo Finance provides information about Barrick Gold Corporation’s (GOLD), stock price, news, quote, and history.

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

royalmint.com

How To

How and why to invest in gold coins

One of the most safe investments is gold coins. This is because they are very reliable and will return great returns if bought at the right prices. There are many types of gold coins and it is easy to get lost in the sea of choices. Below we explain how to choose the best gold coin for your investment portfolio.

Consider the amount you wish to invest. If you only have a small budget, buying gold coins might not make sense. On the other hand, if you have a large budget, it would make sense to buy gold coins as they offer higher profits than most other forms of investment. Start with small amounts of cash to ensure you don’t miss out on potential profits later.

Next, think about what return you would expect to get from investing in gold coin investments. There are two main types for gold coins. These are physical gold and paper certificates. Physical gold coins are made up of actual gold bars, whereas paper gold certificates are just pieces of paper representing some form of value. It is important to look for gold coins that offer a high rate of return. It is important to compare historical rates of return with the current market price of gold coins. For example, if you were looking for gold coins that gave you a 5% return per year, then you could use the following formula to calculate the number of years it would take to recoup your initial investment:

Number of Years Initial Invest / (5% x No. Of Years)

If you know how many years it takes to make a decision about buying gold coins, you can then decide whether it makes sense. You should note that the above equation assumes that you buy gold coins at the beginning of every year. If you buy your gold coins at year’s end, you will need to add another year.

You also need to verify the minimum investment amounts of each gold coins. Some companies will require higher amounts to sell gold coins while others may allow you as low as PS1. Again, it will depend on how large your budget is and how much money you are willing spend.

Finally, you should consider the safety of purchasing gold coins. Many people worry about losing their hard-earned cash to fraudsters. Buy gold coins only from reputable companies to combat this problem. Be sure to verify that the company dealing with you is registered and that they belong to the British Bullion Association. You should also be cautious about purchasing gold coins online due to the many scam sites.