Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

Amongst all of the other bird species in the world, the American Golden Eagle is one that has the most fascinating history. This species, which is actually one of the most common birds in North America, has long been a symbol of America. Its migration, behaviors, and range are all interesting topics to explore. Moreover, there are also some lesser known aspects to the eagle that are not well understood. This article explores some of these aspects.

Migration

During the winter, the American golden eagle migrates from Alaska to the northern U.S. and Canada. This short- to medium-distance migrant relies on a variety of prey species, including prairie dogs, grouse, rabbits, bighorn sheep, pheasants, hares, and marmots. It is also an avid carrion feeder, consuming the carcasses of deer killed by hunters.

It is also known to mate for life. A pair may construct two or three nests in the territory, and reuse them over several years. During the brooding season, the female delivers the bulk of the nesting material.

The American golden eagle is protected under the Bald and Golden Eagle Protection Act. It is also listed as a threatened species under the Migratory Bird Treaty Act.

Breeding range

During the breeding season, the American golden eagle is a migratory bird. The northern part of its range is located in Canada, Alaska, and northern Mexico. The eastern and western parts of its range are located in the United States.

The northern breeders of the golden eagle migrate to wintering grounds in southern Quebec and southern Ontario. Some breeders travel over 5000 km between breeding and wintering areas.

The eastern population of golden eagles is under the protection of the Bald and Golden Eagle Protection Act. Their last documented nesting attempt was in Maine in 1996. However, the eastern population is still relatively small and faces a variety of threats.

The Golden Eagle is a large predator. It feeds on a variety of prey species, including rabbits, pheasants, prairie dogs, and ground squirrels. It also occasionally takes mountain goats, bighorn sheep, and other mammals. The majority of the prey taken by the golden eagle is rodents and rabbits.

Habitats

Generally considered a diurnal bird, the golden eagle has an active life style, hunting during the day, and sleeping at night. They are able to travel long distances to find food, and if their prey is scarce, they might even eat carrion.

They are found throughout North America. Their habitats include deserts, mountain ranges, rolling hills, grasslands, shrublands, rocky outcrops, and agricultural areas. Their preferred habitat is open country. They will nest on cliffs, in forest, on bare ground, or in other vegetated areas. The nests are made of sticks and soft material. The eggs are hatched in forty days.

The American Golden Eagle is a bird that is primarily a hunter. They hunt ground squirrels, hares, and rabbits. They also use talons on their feet to kill prey. During the winter months, they eat carrion, and may also feed on marmots, coyotes, badgers, and cranes.

Behaviors

Compared to other birds, the American golden eagle is a top predator. In addition to hunting small mammals, the eagle will also attack larger animals such as seals, bighorn sheep, mountain goats, and coyotes. However, the eagle is primarily a small mammal hunter.

The Golden Eagle’s primary prey species are black-tailed jackrabbits and prairie dogs. Its secondary prey include young deer and small rodents. It also eats carrion and birds.

The male golden eagle usually demonstrates an aerial display during courtship. This is done by making a shrill, high-pitched sound. It also displays its claws and simulating a mock attack.

The breeding season of the American golden eagle begins in January and ends in May. The eagle pairs typically build multiple nests over the course of several years. They line the nests with aromatic leaves, local vegetation, and sometimes bones and other human-made objects.

Symbolism

Throughout history, the American golden eagle has had a number of meanings. In some cultures, it has been a symbol of courage and strength. In others, it symbolizes freedom. In still others, it has been a symbol of masculinity. Whatever the meaning, the eagle has a strong presence in our culture.

The Comanche people regarded the eagle as a sacred bird. In their rituals, the eagle is used to represent the Great Spirit. They also perform the Eagle Dance to honor the eagle’s life story. It is said that the eagle has the ability to travel between the physical and spiritual world. The eagle is also a symbol of strength, nobility, and protection.

Eagles are also symbols of freedom and independence. They have been associated with new political and economic heights.

Frequently Asked Questions

Should I make my IRA gold?

The long-term investment in gold is gold. It’s more than a trendy short-term investment. There are many options if you require cash immediately.

You may want to keep your money in a diversified portfolio of stocks, bonds, mutual funds, and exchange-traded funds (ETFs). If you don’t have retirement savings, you might consider opening a Roth IRA.

A Roth allows you money to be withdrawn tax-free in your retirement years.

Roths have the advantage that you can withdraw money at retirement as ordinary income rather than making contributions. The money grows tax-free.

You won’t owe any taxes on the earnings of a Roth IRA until your retirement.

You can only contribute as much to one type of account while you’re working. However, the IRS caps your contribution limits if you are not yet 50. For 2018, those limits are $5,500 per year ($6,500 if you’re 50 or older) for a Traditional IRA and $1,000 per year ($1,100 if you’re 50 or over) for a Roth.

Remember that gold is an inflation-prone currency. You could lose value over time.

How can I place gold in my IRA account?

The best way to invest in precious metals is by purchasing them directly from mining companies. This allows you to avoid middlemen and gives you full control over the amount of gold you own.

An Individual Retirement Account (IRA) is the most popular way to invest in precious metals. If you are less than 59 1/2 years old, it allows you to save money taxes-free. These funds are available for retirement after they have grown in size.

Fidelity Investments should be your first choice for an account. They offer several different types of accounts, including Gold IRAs. They also provide mutual fund options that allow you to diversify your portfolio of investments. These mutual funds can be a great way for you to invest in precious metals. You can easily buy and sell shares of stock, without having to take out debt.

After you open an IRA, it is time to decide whether or not to purchase physical bullion. Since it will hold its value through economic downturns and is considered to be the most safe, physical bullion should be your first choice. Although CDs are less stable than bullion they aren’t as secure.

Certificates are available in both interest bearing and noninterest bearing varieties. While interest-bearing CDs offer higher returns, they require that you keep your cash invested for a longer time. Although they offer a lower return, non-interest bearing CDs are safer and more secure.

How much gold can I keep at home?

The average person keeps around $500 worth of gold at home. Bullion bars might be a good investment choice if you’re looking to make a profit. These are solid metals that contain real gold. They could be sold to make more money.

You should only invest in something that makes sense for you. Talk to a financial adviser if you’re not sure where to start. They will help you determine which investments are best for you.

Is there a better way to keep physical gold?

It holds gold bars together with silver alloy, making them extremely heavy and easy for storage. The metal could be damaged if they are kept in wooden boxes.

They should be kept clear of heat sources like radiators.

Safest place to store your gold is in an enclosed vault, which can’t be moved or touched. This makes it the safest option for any bank’s deposit box.

How does a gold IRA earn money?

It can make money investing in gold. Each year, you get interest based on how much gold you have. You don’t have to pay any fees for owning gold in your IRA.

What is the tax on gold in an IRA

The IRS allows you deduct investment expenses, such as taxes, from your income. You may also deduct interest paid on loans used for business purposes.

This includes qualified dividends (capital gains), and losses. However, if you are not eligible to take these deductions because they exceed $3,000 per year ($1,500 if married filing separately), you cannot deduct them.

This deduction must be claimed every tax year. You can carry these losses into the following years if there is a loss. Profits made in one year can’t be used to offset losses.

Should I own physical gold?

Consider these questions when deciding whether or not to invest in physical gold. Are there signs of inflation? Are you expecting interest rates to increase?

Do you value safety or liquidity more? What will you do with the money? Are you able to purchase more as prices fall?

All of these are valid questions to ask. But ultimately, the decision boils down to how much risk you’re prepared to take for the potential reward.

You might consider investing in physical gold as it can provide valuable diversification against an uncertain world. However, it’s also possible that the price could plummet, leaving you with a loss.

Consider the risks and weigh them against potential rewards before you make a decision. Before making a decision, it’s important to define your goals as well as the level of return you are willing and able to accept.

Statistics

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

External Links

royalmint.com

nytimes.com

- Safe Deposit Boxes Aren’t Safe – The New York Times

- Are All the Gold & Silver in Storage? (Published 2020)

finance.yahoo.com

- Yahoo Finance: Barrick Gold Corporation (GOLD), Stock Price, News, Quote, & History

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

How To

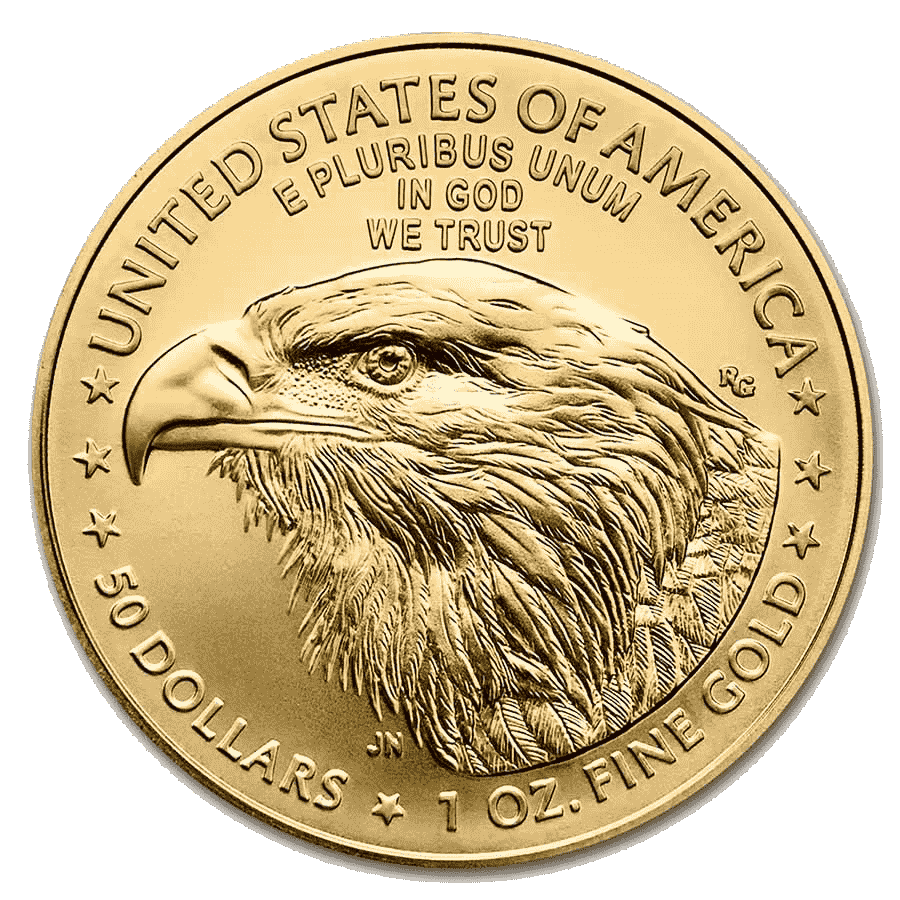

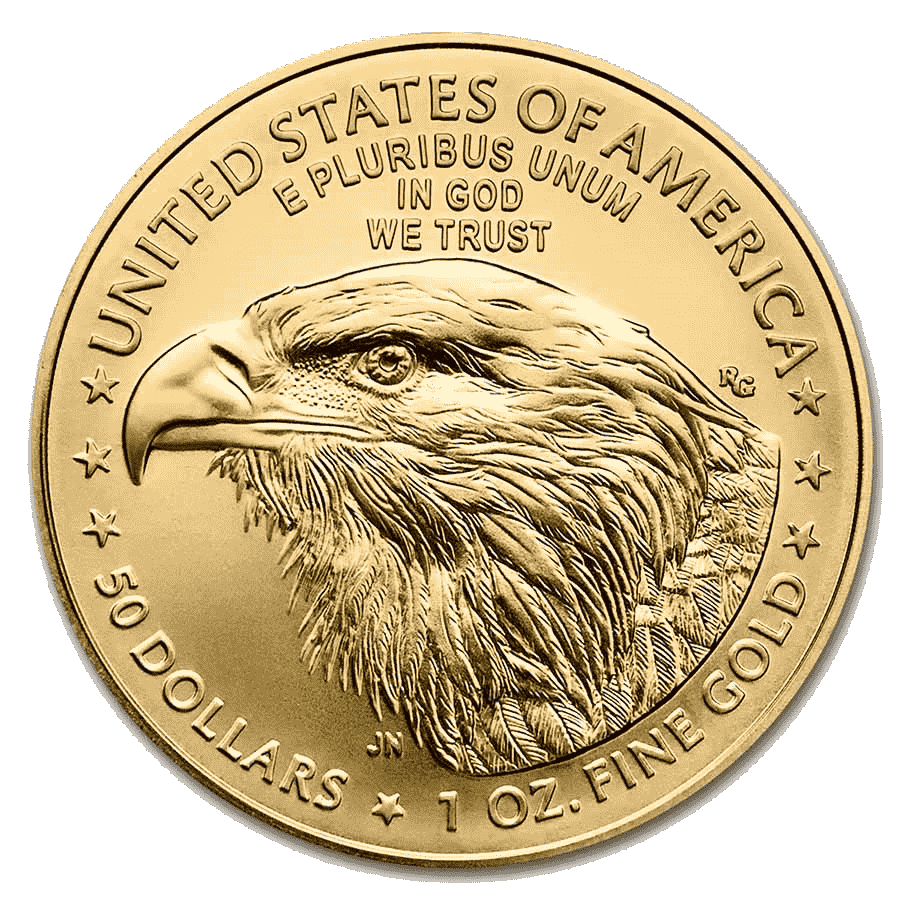

How and why to buy gold coins

The safest investment for any type is gold coins. They are stable and can provide excellent returns if purchased at the right price. Many different types of gold coins are out there, so it is often difficult to decide which one to purchase. Below are our recommendations on how to choose which gold coin is best for your investment portfolio.

You should first consider how much money you are willing to invest. It might not be a good idea to buy gold coins if you have limited funds. On the other hand, if you have a large budget, it would make sense to buy gold coins as they offer higher profits than most other forms of investment. To avoid losing out on future potential gains, it is a good idea to start small.

Next, think about what return you would expect to get from investing in gold coin investments. There are two types of gold coins: physical gold coins or paper gold certificates. Paper gold certificates and physical gold coins are simply pieces of paper that represent some value. You should try to find gold coins that give you a good rate of return. It is important to compare historical rates of return with the current market price of gold coins. If you are looking for gold coins with a 5% annual return, you can use the following formula:

Number of Years Initial Invest / (5% x No. Of Years)

If you know how many years it takes to make a decision about buying gold coins, you can then decide whether it makes sense. The above equation assumes you buy gold coins at each year’s beginning. If you buy gold coins at any time during the year, the calculation will need to be extended by one year.

You should also check the minimum investment amounts for each gold coin. Some companies require larger sums of money before selling you gold coins, while others will allow you to invest as little as PS1. It all depends on your financial resources and what you are willing to invest.

The safety of buying gold coins is another important consideration. Many people worry about the risk of losing their hard earned cash to fraudsters. This problem can be avoided by buying gold coins from reputable firms. Make sure that the company you are dealing with is regulated and that they are members of the British Bullion Association. Be cautious when buying gold coins online, as there are many scam websites.