Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

If you’re interested in investing in a Canadian company, you may want to consider buying a stock in Yamana Gold. This company has gold mines in Canada and Argentina and also operates copper mines in Chile. It’s a company you can trust and its stock price has risen considerably over the years.

AUY’s underlying business fundamentals

When it comes to Yamana Gold, one can only wonder if the hype was deserved. Nevertheless, a quick glance at the company’s financial statement tells that it has a robust business model. Despite a lukewarm recovery from the gold rush days of old, the company is on the right track, as evidenced by its streamlined operating procedures and improved cash flow. Fortunately for investors, the neoprene suitors have not yet been slashed, as a result of a recent debt restructuring.

Likewise, the stock has enjoyed a resurgence of its own. The stock has been a popular pick amongst investors and analysts for its robust financials and impressive operating procedures. One of the reasons for this is a favorable debt maturity schedule, which has resulted in a lower net debt to EBITDA ratio. Moreover, the company has been making the appropriate financial moves to boost liquidity, such as prepaying its bills for a reduction in interest payments.

PEG ratio

A PEG ratio of Yamana Gold stock is a measure of the relative trade off between a stock’s price and its earnings growth. It is a useful tool for comparing the share prices of high-growth companies. The lower the PEG, the better.

However, there are some important factors to consider when calculating this metric. One key factor is the growth estimate used in the calculation. If the company’s growth estimates are less than expected, the PEG ratio may be negatively impacted. Another common factor is accounting anomalies, which can include restructuring costs and changes in tax law.

To calculate the PEG of Yamana Gold, you should begin by dividing its price per share by its earnings per share. Once you have this number, you can then add up the growth rate over the past twelve months. For example, if the estimated growth rate of the company is 20%, you would multiply this number by 100.

Trailing price/earnings ratio

There are many different ways to measure the success of a company. The price/earnings ratio (P/E) is a commonly used metric. This formula reflects the current share price divided by the earnings-per-share based on the last twelve months. It is useful for comparing the prices of high-growth companies. However, it does not take into account the company’s projected growth rate.

Another metric to consider is the PEG (price to earnings) ratio. While the P/E ratio provides a quick comparison of the price of a stock to its earnings, the PEG ratio provides a more comprehensive view. In other words, it shows how a company’s current share price compares to its expected future earnings.

One of the most common indicators of a company’s success is the growth rate. For example, a company that has achieved a 2,500% increase in revenue per quarter is an outlier. However, the highest growth metric is not always the most impressive.

Technical analysis gauge

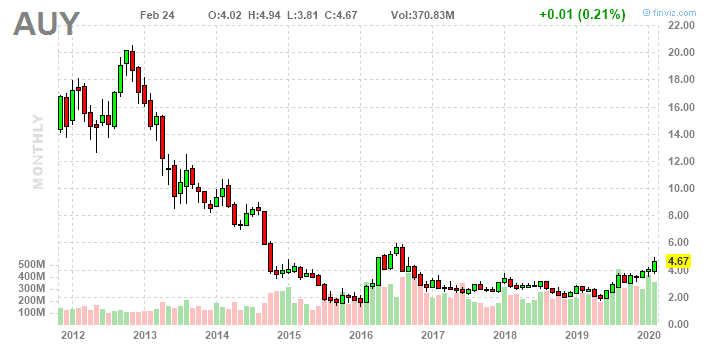

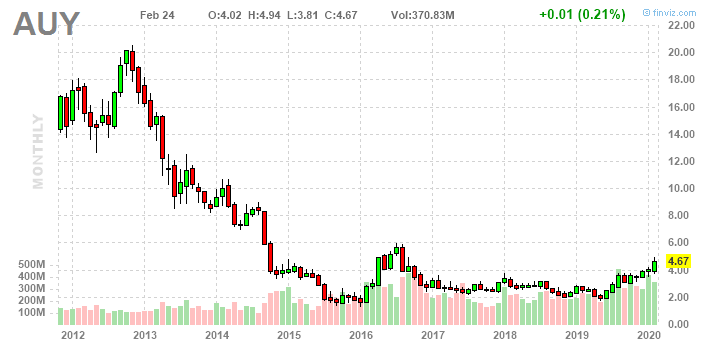

In order to determine the direction of Yamana gold stock’s future prices, you need to understand the technical analysis of this company. This analysis can be accomplished by using a variety of popular indicators.

One of the most important indicators to look for is the price action. A green candle is a sign that the market is buying. Conversely, a red one indicates that sellers are dominating the session.

Another popular indicator is the Relative Strength Index. This indicator is designed to follow existing trends and identify reversal spots. It uses a combination of momentum and short-term technical analysis.

The TA Score for AUY shows that the stock is in an uptrend for the short-term. Over the past 12 months, the stock has grown in tandem with GOLD’s growth.

If you’re a longer-term investor, you may want to look at the weekly chart. If you’re a shorter-term trader, look at the daily chart.

Aside from price, you should also check out the companies’ price-to-sales and price-to-book ratios. These are indicators of how much value investors think the company has.

Frequently Asked Questions

Are gold IRAs a good idea.

The answer depends on who you are asking. If you’re just starting out, they might help you to grow wealth over time. There are better ways to put your money if you have an established business.

For example, you might start a company. This gives you more control of your finances than buying silver coins through an IRA.

You might also think about selling your gold coins and using the proceeds to buy stocks or bonds. This will allow you to diversify and increase your portfolio.

If you plan to retire early, an IRA can be a valuable asset. When you reach retirement age, your assets can be withdrawn from your IRA without any taxes.

However, this does not mean that only one type can be used to buy gold coins. There are many other accounts that offer different investment options. For example, you could open a stock brokerage account and begin trading shares. You can also set up an online banking account and start making withdrawals and deposits.

How do I buy gold coins for an IRA

It is essential to know what amount of money you have (or which type of account it is) in order to buy them. A bank might offer to sell $10,000 worth physical gold coins if you don’t want to use cash. If you have a retirement plan at work, they may allow you to make a withdrawal from your 401(k). This is called a direct rollover, and it is usually free. The IRS requires that withdrawals from a retirement plan be made only by buying physical gold coins.

You could also transfer funds directly into a traditional IRA from another investment account if you have a traditional IRA. It’s called self-directed IRAs, and it is not required to be done this way, but most people choose to do so. Contact your financial advisor and let him/her know which accounts you’d like to transfer the money into. Your advisor will then transfer the money to your IRA.

You can also buy physical gold coins online through platforms such as coinbase.com or bullionvault.com These online platforms act as intermediaries between buyers and sellers, and they charge fees. They store the coins until they are purchased by someone, then they deliver them to the buyer upon payment.

How much tax is gold subject to in an IRA

The IRS allows you deduct investment expenses, such as taxes, from your income. Also, interest paid on loans made for business purposes can be deducted.

Qualified dividends, capital gains and losses are all included. However, if you are not eligible to take these deductions because they exceed $3,000 per year ($1,500 if married filing separately), you cannot deduct them.

This deduction must be claimed each tax year. You can carry these losses into the following years if there is a loss. However, losses cannot be used to offset profits from another year.

How do you store 1 oz gold bars?

If you buy gold for storage, choose a reputable company. Different companies offer different levels of security when it comes to gold storage.

Some companies might have multiple accounts that allow access to the same account. This could mean more than one person is trying to steal your precious metal. You might lose your precious metal because someone else stole it while you weren’t watching.

Also, you want to make sure the vault is safe and secure against theft. Some vaults are found inside buildings that can be easily hacked into. Some vaults are located in buildings that can be easily broken into. Others are buried underground making them harder to access.

Make sure you get 24-hour protection from an armored car service. You should ensure that they provide insurance coverage in case of damage to your vehicle.

Finally, ensure that you track your gold and its location at all times. It is best to store your gold in a safe place. To make sure nothing happens, you should check the box every so often.

How much does it cost for gold to be stored in a bank?

To keep this amount of gold safe, banks pay 1,000,000 dollars each year. Banks charge you to store your gold at the bank.

You have many options to protect your savings from theft or other disasters. An insurance policy will protect you against losing your money. You could also invest in gold bullion. Gold bullion has a physical form. It is a tangible form of money because everyone agrees that it has value.

Banks store gold bullions as legal tender. They’re not just kept in vaults but also used to make jewelry. They’re also available for purchase in shops across the globe. It doesn’t matter where you store your gold bullion. Your gold is always ready for you when you need.

Talking with your financial adviser is the best approach to deciding how much gold you should buy. He’ll explain the available options and help determine if gold investment is right for you.

How does an IRA for precious Metals work?

You can invest in precious metal IRAs (PMIRA) to buy physical gold, palladium, platinum and silver bullion coins. Income taxes are not charged on these profits. You can also buy shares in companies that produce these physical products. They are then held in trust until they mature by an independent custodian.

The cash proceeds from the sale of assets are exempted from tax and any capital gains taxes due to their appreciation.

A PMIRA works in the same way as stock investments, but offers more diversification since you own tangible assets. A PMIRA is also less risky that investing directly in equities because you aren’t subject to stock market fluctuations.

The IRS requires that you pay ordinary income taxes on any dividends earned from these investment options. If you are eligible for the Gold Individual Retirement account (IRAs), however, you will not have to pay federal income taxes on any earnings.

In addition, there are state income taxes that you may owe when selling precious metals. These taxes are different from state-to-state. Talk to your accountant or tax advisor about which state you should file.

Where can I store my IRA gold?

It is not recommended to store gold in an IRA account as you will lose control of how much you have.

You cannot also access your funds if you don’t pay taxes.

If you are storing your gold for investment purposes, you might consider other options, such as mutual funds from precious metals.

What is the best way to invest in gold?

Since its discovery, many have chosen gold as their preferred investment.

Although it’s fairly easy to buy or sell gold, there are risks.

It is best to invest in precious metal funds that only invest in physical silver or gold bullion.

Statistics

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- That’s almost a 5% markup over a comparable amount of gold bullion. (forbes.com)

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it. (forbes.com)

- Over the past five years, gold’s price increased by approximately 36%, while the S&P 500 increased by 104% during that same period. (forbes.com)

External Links

investopedia.com

finance.yahoo.com

- Yahoo Finance – Barrick Gold Corporation Stock Price, News & Quote – Barrick Gold Corporation (GOLD).

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

nytimes.com

- The New York Times says safe deposit boxes aren’t secure

- Where is all that gold stored? (Published 2020)

How To

Top Gold IRA Companies – Best Gold Investment Retirement accounts for 2022

The top gold retirement accounts for investment in 2022

For 2022, the best gold retirement accounts (IRAs) are those that allow you to invest money without worrying about taxes or fees. You can buy shares in stocks, bonds, commodities, real estate, etc. Our calculator will show you how much you can earn.

There are many ways to invest in precious metals like gold, silver and palladium. These companies provide clients with a safe and secure place to store their wealth. They also offer tax advantages as well as low transaction costs.

You have many advantages to precious metal IRA investment. Precious metal IRA investments offer diversification from traditional asset like stocks and bonds. Diversifying your portfolio means that even if one asset loses value, the other will not. In addition, these investments tend to hold up well during economic downturns. You might still be able to make a profit even if things turn bad, as opposed to someone who invested in volatile stock markets.

One of the benefits of precious metal IRAs investing is their higher interest rates. A 10% annual return on precious metals investments could mean $100 extra per month in your pocket!

Precious Metal IRA companies usually don’t charge sales commissions so there are no hidden fees. Plus, there is usually no minimum account amount. You will find many savings options, whether you are looking to open a bank account or move funds to a new IRA.

If you intend to take advantage federal government’s tax free status, make sure the precious metal IRA companies you choose offer qualified plans. Two types of qualified plans are available: 401(k), and 403 (b) plans. These plans allow you to make pre-tax contributions to a Roth IRA. However, only 401k plans allow you withdrawals of your contributions after you turn 59 1/2.

You don’t have to wait until you retire to invest in precious metal IRAS. Because they can defer taxes, many people use their workplace IRAs to invest in precious metals. Your employer doesn’t have any limits on how much you may contribute to your workplace IRA, unlike other IRAs.

Some employers will even match your contribution. Your savings could be increased by thousands of dollars if your employer matches your contributions.

Don’t wait! It has never been simpler to invest in precious-metal IRAs.