Affiliate Disclosure: The owners of this website may be paid to recommend Goldco Direct. The content on this website, including any positive reviews of Goldco Direct and other reviews, may not be neutral or independent.

Investing in an Exchange Traded Commodity is a great way to earn an income, but there are a few things to keep in mind. These include the Reuters / CRB index, physical secured gold ETCs, futures contracts, regulations and more.

Physically secured gold ETCs

Using physically secured gold ETCs can be an effective strategy for investors looking to gain exposure to the gold price without having to purchase or store physical gold. Physical gold is less liquid than other commodities and may be costly to store. In addition, ETCs do not charge an entrance fee, exit fee or performance fee. The value of physical gold ETCs is directly related to the spot price of gold. Unlike ETFs, these products do not charge a performance fee or entrance fee.

There are two main types of physically secured gold ETCs. One type is fully collateralised and one is completely backed. It’s important to understand the differences between these two types before you decide which one to invest in.

Fully collateralised ETCs are backed by cash investments, high credit rating securities or loan collateral. They are also backed by daily collateral checks. The issuer buys a certain amount of physical gold and then stores it in secure vaults.

RMAU ETC

RMAU ETC is the first gold backed exchange traded commodity to be launched in Europe. Its launch follows a partnership between The Royal Mint and white label ETF specialist HANetf. Its first tranche of 100 percent recycled gold bars will include 50,000 ounces of surplus gold from bullion coin production. The number of recycled bars will increase over time depending on demand.

As the world’s leading export mint, The Royal Mint has a long history of precious metals expertise. Its portfolio is diversified and its 1,100-year reputation for security is built on trust. It is also the official coin provider for the UK.

The Royal Mint will provide the physical gold associated with the ETC, which will be stored in its vault in Wales. The physical gold bars used for the ETC are backed by 100% by the London Bullion Market Association.

Futures contracts

Agricultural futures contracts are available for various commodities including milk, fiber, and lumber. These contracts are useful for speculators who expect the price of the commodity to rise or fall.

A futures contract is a legal contract between two parties that requires the buyer to buy the underlying asset at a specified price at a certain time. These contracts are highly standardized and offer both parties a guaranteed rate.

The price of most futures contracts fluctuates during the trading day. The price is also dependent on the distance from the contract month. In some cases, the price may increase or decrease significantly.

The futures contract has a limit, but the limit does not necessarily stop trading. This is because most volume of trading occurs over a narrow price range near the beginning and end of the trading period.

Reuters / CRB index

Originally known as the Commodity Research Bureau Index (CRBI), the CRB Index has been rebranded as the Reuters/Jefferies CRB Index. Its performance has been on the rise recently.

The Commodity Research Bureau (CRB) is a leading supplier of commodities data, and it publishes the most editions of the Commodity Year Book since 1939. The CRB Index provides investors with a measure of the performance of a wide range of commodity markets. The Index follows the general direction of the underlying commodities, but also isolates specific movements.

The Index is composed of seventeen commodity futures contracts. It is traded on the New York Stock Exchange (NYBOT) and the London Metal Exchange (LME). The CRB Index is also available on the Dow Jones Index and the DBC Commodity Index.

Regulations

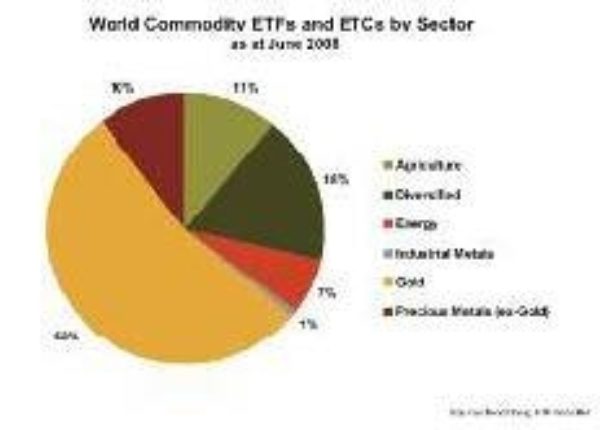

Investing in Exchange Traded Commodities (ETCs) is an interesting alternative to trading commodities in the futures market. ETCs are asset-backed securities that trade like shares, but track the performance of underlying commodities. These securities may represent as much as 20% of an investment portfolio.

ETCs come in four different product categories. They include: commodity ETFs, total return swaps, exchange traded notes, and commodity basket ETCs. They are structured differently by the company issuing the product.

Oil-linked ETPs are a complex product that raises heightened risks. A firm’s obligation to the public in the oil-linked ETP space is to provide a good description of the product’s main features and risks. A firm also needs to be mindful of its obligations to the Commission, including the Reg BI requirements for suitability and supervision.

Frequently Asked Questions

Where is the best place to store gold safely?

At home, gold is the safest place to stash it. This is because you have control over what happens to your precious metal when you most need it. It’s easy to locate it and determine who has access. If you lose your house, you don’t lose your gold.

Keep precious metals safe at your home if it is something you want to do.

Where is the safest place to store your gold?

For valuable items like jewelry and coins, a safe deposit box at your bank is the best choice. The box is secure because a key is needed to access it, and you must present identification when entering the vault. An agreement may also be required that you agree to not take anything without permission from bank.

Although safe-deposit boxes at banks are generally cheaper than insurance, you will need to pay monthly fees for the box to be open. You should consider buying additional coverage if you plan on keeping the contents in there for more than two years.

Many sites offer to store your jewelry online. While some may seem legit, others could be frauds and will steal your personal information to sell your stuff. Make sure you verify the reputation and legitimacy of any website where your gold is stored. Seek out reviews from trustworthy sources and speak with family members who have used the website before.

Can I store my IRA gold at home?

The IRS says no. The IRS says you don’t have to report gains to your IRA account. All your IRA assets can remain safe and sound at home.

How do you buy and safely store gold?

Always keep gold in a safe deposit container at a bank. It is preferable to keep your precious gold at your home. This will make it difficult to retrieve quickly in times of emergency. The most common type of safe deposit box is fireproof safes. Banks use them to protect their valuables from theft. You can store your gold in a fireproof safe. However, they are expensive. It is better to purchase a basic safety box from your local bank. These boxes are affordable at less than $100 each year. They are not only affordable but also offer security features like keyless entry.

Another option is to store your gold at a reputable precious metals dealer. Many dealers offer free storage services so that you don’t need to worry about finding somewhere to store your gold once it is purchased. Some dealers even offer discounts on storage fees if you purchase multiple items at once.

Make sure your gold is secured if you intend to keep it at home. You must ensure that nothing can get into the room where your precious gold is stored. Also, make sure no one has keys to the room. If keys are found, immediately change locks.

The Federal Deposit Insurance Corporation will insure your gold if it is stored in a bank. If your bank closes, the government will take over all deposits of up to $250,000.

Statistics

- But like gold coins, you’ll probably be paying extra for the amount of gold you’re getting—a premium that could be anywhere from 20% to 300%, depending on the manufacturer. (forbes.com)

- This could be anywhere from 20% to more than three times the precious metal’s raw value. (forbes.com)

- Purity is very important when buying gold: Investment-quality gold bars must be at least 99.5% pure gold. (forbes.com)

- That means you’re probably targeting gold items that are at least 91%, if not 99%, pure. (forbes.com)

- 10K 41.70% 14K 58.30% 18K 75.00% 22K 91.70% 24K 99.90% (forbes.com)

External Links

forbes.com

finance.yahoo.com

- Barrick Gold Corporation (GOLD) Stock Price, News, Quote & History – Yahoo Finance

- Franco-Nevada Corporation (FNV) Stock Price, News, Quote & History – Yahoo Finance

nytimes.com

- The New York Times: Safe deposit boxes aren’t safe – The New York Times

- Where is all the gold being stored? (Published 2020)

How To

How to Invest Gold: 5 Ways to Buy and Sell it

One of the best ways to make money is by investing in gold. There are many options for gold investing. It can be difficult. Before making an investment decision, you must first know what you want. This article will teach you the basics of investing in gold. These are five ways to buy or sell gold.

- Before buying precious metal, understand your goals. Do you need to save up for an important occasion? Do you just wish to diversify the portfolio? Or do you plan to use the metal as an investment? Once you understand why you want to buy gold, you will be able to decide which type of the metal might work for you. If you are saving for a large purchase, you might not want to buy gold coins. You can instead invest in bullion bar containing a small amount of pure gold. Alternatively, if you’d rather avoid storing physical objects, you could opt to invest in shares of a gold mining company.

- How to Choose the Best Gold Type To Invest in – Once your reasons for wanting gold are clear, you can begin looking into different gold types. There are two major types of gold: white and yellow. Yellow gold is low in impurities, like silver and Platinum. White gold, on other hand, contains a lot less impurities than yellow gold and so is less expensive. If you are considering purchasing gold, it is worth considering whether you prefer white gold or yellow. Krugerrands will suit you if white gold is your preference. They are the best white gold in the world.

- You Should Choose a Reputable Company that Can Provide Excellent Customer Service. When you are looking for a trustworthy company to trade with you need to look at their customer service records. A good company will always offer excellent customer support. They won’t charge exorbitant fees and will provide regular updates about your investments. Additionally, you should ask potential companies several key questions. You should first find out how long the company has been trading. Second, ask them how experienced they are. Finally, find out how they store your gold. Find out how they protect you interests.

- Know How Much gold is worth – Next you need to know how much gold it is worth. Many websites will give you an estimate of the current value of gold. Many sites allow you to compare prices across multiple sources. For example, you can search for the price of gold on Yahoo Finance. This will allow you to compare the prices against those found on other sites. This will give you an accurate estimate as to how much gold is today.

- You Must Learn When to Buy and Sell. Many people attempt to time the market by waiting till the last minute. Unfortunately, this often leads to missed opportunities. You should therefore take enough time to fully research the information available before you make a decision. You must also make sure you only invest what your finances can bear. It is important to remember that buying gold should not be done impulsively. It takes careful planning.

In short, investing in gold is one of the most rewarding things you can do. However, there are many ways to go about doing it. Hopefully, this article has given you the knowledge you need to make the right decision.